Is the Stock Market Too Concentrated?

Matt Carvalho, CFA, CFP®, Chief Investment Officer, Cardinal Point Wealth Management

It probably doesn’t come as a surprise that Amazon, Netflix, Microsoft, Apple, Alphabet and Facebook have been some of the best performing stocks in the first half of this year. But what may be surprising is that those six stocks made up 98% of the S&P 500 Index returns for the first half of 2018 according to a recent CNBC article1!

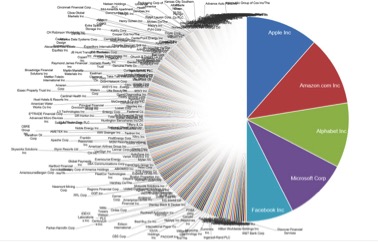

Many headlines over the last year have pointed out just how large these tech giants have grown For the first time since 20002, the tech sector now represents 25% of the S&P 500. When viewed another way, the market capitalization -the amount investors have deemed the companies are worth- of the top (largest) five companies is approximately equal to the bottom (smallest) 282 companies in the S&P 500, as illustrated by the amazing pie chart below created by Michael Batnick of Ritholtz Wealth Management3.

Weight of Top 5 Companies in S&P 500 Versus Bottom 282 Companies

In other words, the bottom 56% of the S&P 500 has the same market capitalization as the top 1%. That’s a lot of companies. Those 282 listed include many household names such as Chipotle, Kohl’s, Clorox and H&R Block, all of which are multibillion-dollar firms on their own. Which begs the question, is it typical for a handful of the largest companies to dominate an index?

It turns out that historically it’s not uncommon for the largest companies to represent an enormous percentage of the index. Today the largest 10 companies represent a little over 20% of the large cap space That’s right about the average we’ve seen over the last few decades, and significantly lower than it was in the 1960s, according to a recent study by Travis Fairchild at O’Shaughnessy Asset Management4. This study also found that on average, about 6-7 of the top 10 names fall out of the top 10 within the following decade, suggesting that many of the current top ten companies will be replaced in the next ten years.

This phenomenon isn’t limited to just the U.S. According to Benjamin Felix of PWL Capital, through July 13th of this year, 75% of the S&P/TSX return came from just 10 of its 246 stocks, led by Suncor Energy, Toronto-Dominion Bank and Shopify5. This may lead you to ask, is there anything I should be doing as an investor to take advantage of this?

First off you should note that well diversified portfolios likely hold all the names mentioned in this piece; Amazon, Apple, TD, etc. are some of the largest holdings for most North American investors. But investing a portfolio solely in those largest companies has two pitfalls - undue concentration of risk and missed opportunities in other areas of the market.

The first pitfall of investing solely in individual names - even some of those red-hot tech stocks, came home to roost at the end of July. Both Facebook and Twitter reported earnings which fell short of market expectations. On July 26th, the day after their quarterly earnings announcement, Facebook fell by a whopping 19%, erasing $120 Billion USD in value! This amount is greater than the entire value of large companies like GE, Nike or Starbucks. A day later, following Twitter’s earnings announcement, that stock also fell 19%. Twitter had been one of the best performing stocks over the previous year prior to that announcement.

While these companies are included in most major stock market indexes, the performance of any individual company is going to be relatively small in comparison to the entire index - for example the S&P 500 was basically flat on July 26th, even with Facebook falling dramatically. But if you owned them individually - they would likely represent a far greater percentage of your overall assets.

Another major downside of only holding those largest of companies is missing out on large potential gains elsewhere. Small companies outperformed their large cap counterparts in the U.S. and Canada significantly over the second quarter of this year. And academic research shows that historically small companies have outperformed their large counterparts over decades6. Yet for the average investor, it’s difficult to not want to go all in on the large gains you’ve recently seen on familiar companies you likely interact with every day.

If outperforming were as easy as picking the recent winners and calling it a day, active fund managers would have a far better track record than they currently do. Yet, the record of both U.S. and Canadian active stock managers is poor, supporting the idea that it’s extremely difficult to outsmart the market and predict in advance who the winners of tomorrow will be.

Like the Apples or TDs of today, or the IBMs or Blackberrys of the past, a few large high-flying companies will often garner the headlines. Yet the key to reaching your financial goals is not the fool’s errand of trying to guess what the wonder company of tomorrow will be, but in keeping a well-diversified portfolio that will own all the companies that may provide that growth.

Matt Carvalho, CFA, CFP® oversees Cardinal Point’s Canadian and U.S. investment management strategy and process. His former role was Vice President, Portfolio Strategy for a $17 billion dollar Turnkey Asset Management Provider or TAMP. While in this role, Matt served with Dr. Harry Markowitz (Nobel Prize winner in economics) and Dr. Meir Statman (expert in behavioral finance) on a six person investment committee offering advice to the TAMP.

Cardinal Point is an independent Canada-U.S. cross-border wealth management organization. Our advisors operate under the fiduciary standard and provide solutions to high-net worth families, individuals, and related institutions. As a respected thought leader, Cardinal Point has been featured and asked to comment on Canada-U.S. planning subjects in over twenty-five publications and videos, including the Wall Street Journal and Globe and Mail.

To learn more, please visit cardinalpointwealth.com or contact us.

1Just three stocks are responsible for most of the market’s gain this year, CNBC, Jul 10, 2018

https://www.cnbc.com/2018/07/10/amazon-netflix-and-microsoft-hold-most-of-the-markets-gain-in-2018.html

2S&P 500 Hits Tech-Heavy Milestone Last Seen With Dot-Com Bubble, Bloomberg, Feb 28, 2018

https://www.bloomberg.com/news/articles/2018-02-28/s-p-500-hits-tech-heavy-milestone-last-seen-amid-dot-com-bubble

3@michaelbatnick tweet, July 18, 2018

https://twitter.com/michaelbatnick/status/1019680856837849090/photo/1

4@tbfairchild tweet, Jun 6, 2018

https://twitter.com/tbfairchild/status/1004375185179529217

5@benjaminwfelix tweet, July 13, 2018

https://twitter.com/benjaminwfelix/status/1017869943226937345/photo/1

6 Common risk factors in the returns on stocks and bond, Journal of Financial Economics 1993