A New Beacon in Downtown Los Angeles: The California Market Center

Since its inception over 50 years ago, the 1.8 million square foot California Market Center complex has stood as a cornerstone of Los Angeles’ wholesale apparel industry. Drawing manufacturers, distributors, buyers, and industry events from across the region, CMC has a long and respected history as the West Coast’s industry hub.

Today, that promise still holds true as CMC is at the epicenter of Downtown Los Angeles’ renaissance. Located in the heart of the Fashion District, CMC boasts large floor plates and an airy indoor-outdoor design unlike anything else in the region.

Reinvented

Since its inception over 50 years ago, the 1.8 million square foot California Market Center complex has stood as a cornerstone of Los Angeles’ wholesale apparel industry. Drawing manufacturers, distributors, buyers, and industry events from across the region, CMC has a long and respected history as the West Coast’s industry hub.

Today, that promise still holds true as CMC is at the epicenter of Downtown Los Angeles’ renaissance. Located in the heart of the Fashion District, CMC boasts large floor plates and an airy indoor-outdoor design unlike anything else in the region. It is steps from a large concentration of new residential developments, top hotels, lauded culinary and cultural institutions, public transit, and freeway access. The near-complete mixed-use complex has been reinvented to appeal to the rising influx of technology, entertainment, media, and fashion industries heading downtown LA.

Where Ideas Take Space

Today’s DTLA is more than just a place to work and commute home for the night. It’s arrived as a global neighborhood with a local vibe, replete with the best offerings in entertainment, arts, and culinary spheres, attracting over 500,000 visitors daily. From Lakers games and headliners at its historic theaters to renowned exhibitions at the Museum of Contemporary Art, downtown commuters, residents, and visitors have access to it all.

The neighborhood surrounding CMC is studded with the best of LA restaurants, ideal for lunch with colleagues or dinner with clients. Helmed by established chefs and industry-darling newcomers, current spots at the top of everyone’s lists include Cara Cara, Orsa & Winston, Rossoblu, and Otium, to name a few.

LA’s most buzzed-about hotels are walking distance from CMC, or just a short scooter ride away. While the ACE Hotel really set the tone for the new wave of hotels, downtown LA recently welcomed The Hoxton, Proper Hotel, and the Freehand to the neighborhood. Exclusive partnerships with many DTLA hotels offer CMC visitors significant discounts to boot.

Surrounding CMC are some of downtown’s newest places to live. With over 80,000 residents living in DTLA, the concentration of locals living in and visiting the Fashion District and its businesses create a dynamic community of professionals, entrepreneurs, and creatives in a compact urban radius.

A Space for Creation and Innovation

THE BUILDINGS. Encompassing an entire city block and bounded by 9th, Main, Olympic and Los Angeles, CMC currently consists of three interconnected 13-story buildings (Buildings A, B, and C).

THE REPOSITIONING PLAN. As part of its multi-million-dollar plan to reimagine the complex, Brookfield Properties, supported by world-recognized architecture and design firm Gensler, completely modernized and reworked the entire brutalist-style building complex.

To create greater synergy and connectivity among the long-time fashion tenancy at CMC, Brookfield consolidated fashion tenants and fashion activity from the collective CMC complex in Building C, creating a vibrant, modern destination for fashion commerce and creativity.

The sleek, contemporary fashion-focused building is the exclusive new home for a carefully curated selection of fashion showrooms and events. Currently, the building hosts many of the top brands representing the cross-section of fashion’s diverse markets, including Paige Denim, DL 1961 Premium Denim, Claire DesJardins, Frank Lyman, FILA Heritage, Timex, eS Skateboarding, Splendid Kids, and Little Marc Jacobs to name just a few.

Buildings A and B were entirely modernized and renovated to appeal to companies looking for large, open floor plates interconnected by airy outdoor sky bridges and meeting nooks. The new design also boasts an exclusive tenant-only fitness studio and an unmatched 5,000 square foot rooftop deck with sweeping views of the LA Basin.

CREATION OF PUBLIC SPACE. Brookfield demolished a former bank building, which blocked site lines from the surrounding community. In removing this structure, which was not original to the complex, Brookfield has unlocked a prime street corner to the public and will deliver an inviting, contemporary landscaped public space to the vibrant DTLA community.

AN ACTIVE STREETSCAPE. The heart of the site is an expansive pavilion offering clear programmatic areas for café seating, casual gatherings, performance space, and accessible pedestrian pathways.

The ground-level plan introduces 150,000 square feet of local and regional street-level retailers, cultural activations, and amplified connectivity to the surrounding neighborhood.

Urbanspace, a national developer of immersive public markets, will open a curated food and beverage experience on the ground level of the complex. The 15,000 square foot space will be the first Urbanspace to open in Los Angeles. In total, the new downtown Urbanspace location is expected to feature a mix of 19 food and beverage offerings curated locally from Los Angeles and iconic concepts from Urbanspace food halls across the country.

Transformation Delivered

CMC is where history meets innovation. This icon of the West Coast fashion industry is evolving into L.A.’s new hub for visionary leaders and forward-thinking entrepreneurs influencing the global business and creative communities.

Imagine an aesthetically elevated and creative business environment that inspires ingenuity… a place where diverse industries intersect, cross-pollinate, and spring forth unexpected opportunities… a stimulating and experiential place where the convergence of commerce, creativity, and events enable serendipitous connections and nurturing of relationships.

CMC will be the place where this vision manifests reality and ideas take space. Learn more about the new CMC by visiting: www.cmcdtla.com

Find Out Why Green Battery Production Will Be All Powered by Québec

Québec is all set to become the North American leader in the manufacture and assembly of lithium-ion batteries. An economic powerhouse in its own right in Canada, Québec is strategically located to tap the U.S. market and its enormous potential for electric transportation. The province is primed to make a sizeable investment to develop a battery industry and accelerate the transition to electrified transportation.

Dolbeau-Mistassini, Québec, Canada. Photo courtesy of Céline Chamiot-Poncet.

Québec is all set to become the North American leader in the manufacture and assembly of lithium-ion batteries. An economic powerhouse in its own right in Canada, Québec is strategically located to tap the U.S. market and its enormous potential for electric transportation. The province is primed to make a sizeable investment to develop a battery industry and accelerate the transition to electrified transportation.

“This is a booming global market that offers tremendous opportunity. Québec already has everything in place to create a full value chain for lithium and become an industry leader,” said Guy Leblanc, President and CEO of Investissement Québec.

Competitive edge

Québec has got what it takes to successfully roll out its strategy and create a true ecosystem—from ore extraction to battery production and recycling. What’s more, the largest city in the province, Montréal, is an intermodal transport hub for goods destined to the North American and international markets. But that’s not all. Québec also has:

Critical and strategic minerals: The province has huge mining potential, boasting significant reserves of key mineral resources such as lithium, nickel, cobalt, graphite, silicon and manganese—all of which are essential for manufacturing batteries. These ore-bearing minerals can be extracted and processed locally.

Clean, low-cost renewable energy: Hydropower provides green, renewable energy with a small environmental footprint. Basically, Québec can produce the cleanest battery in North America.

Top-notch R&D capabilities: With leading researchers, a portfolio of more than 850 patents, and world-class universities that feed the pipeline with highly skilled talent, Québec is a battery R&D force to be reckoned with.

Manufacturing expertise: The province has over 60 companies operating in the smart electric transportation industry. They include big players like Lion Electric—North America’s leading electric school bus supplier, Novabus, AddÉnergie, and BRP.

Access to 1.5 billion consumers: Trade agreements with over 50 countries open up the market to 1.5 billion consumers.

One of the lowest operating costs in North America: Québec has the most competitive electricity rates and one of the lowest office space rental costs in North America, combined with a favourable tax treatment for businesses.

Equipment manufacturers within easy reach: Québec is close to major automakers that are investing more and more in EVs. In the past year, Ford, General Motors and Fiat Chrysler each injected $1 billion in the manufacture of green vehicles. Add to that over 700 auto parts manufacturers, and all is set. More than 2 million vehicles are manufactured in Canada every year.

Plus, Québec is a step ahead when it comes to adopting EVs. According to recent data from the Québec Electric Vehicle Association, the province accounts for almost half of the country’s plug-in vehicles. Québec also has the largest network of EV charging stations in the country.

Big government investments, big advantages, big opportunities

The Government of Québec is committed to developing the EV industry to meet its climate targets. Along with California, Québec makes its mark as a North America leader in the electrification of transport. To make sure the province stays on track, major investments in both the public and private sector are planned, and could reach $7 billion within 10 years.

Investissement Québec, the investment arm of the provincial government, plays a key role in the province’s strategy to develop the industry by providing financing, and strategic and technological support. The investment agency supports the growth of businesses that are already established in Québec and welcomes international manufacturers of battery assembly components by helping them locate to the province.

To help move forward with the government’s vision, the agency brought in Dr. Karim Zaghib, a world-renowned researcher and lithium-ion battery expert who has been working in the field for 35 years and whose work has resulted in more than 600 patents and 62 licences. Dr. Zaghib plans to encourage new players to join this major endeavour: “Considering its abundant mineral resources, Québec is a prime location for potential international investors engaging in mineral mining and processing,” he said.

“Québec is laying the groundwork to become a global leader in the electrification of transport. It has one of the most favourable environments for doing business, and the financial and tax incentives are very attractive.”

“Furthermore, recent events, such as global political tensions and the COVID pandemic, have shown how important it is to have a stable, reliable and resilient supply chain. This is a real opportunity we need to seize right here,” Dr. Zaghib added.

Innovation and technology are crucial in this field. “Investissement Québec International’s mandate is to meet with global investors to discuss innovative and impactful international projects that will drive the sustainable growth of the global lithium-ion battery industry. By working together, we can create a one of its kind North American hub in Québec,” explained Daniel Silverman, Vice President, Foreign Direct Investment at Investissement Québec.

“As one of the top economic development and financing corporations in North America, and with our regional partners, IQI is a foreign investors’ one stop shop to help them invest, establish, connect, expand, innovate, export, recruit and finance their business operations in Québec,” Silverman added.

Considering that every step of the process can be carried out in Québec, from exploration to mining, processing and, ultimately, recycling, the province is best positioned to produce batteries with a small environmental footprint while creating a stable and secure global supply chain.

For more information on Quebec's green battery expertise, please visit their website at https://www.investquebec.com/international/en.

Minimizing Supply Chain Risk in Uncertain Times

The global pandemic continues to drive uncertainty throughout supply chains, resulting in trade restrictions, supply shortages, logistics capacity constraints, and fluctuating demand for companies. These trends will continue to plague manufacturers and retailers as they struggle to secure raw materials, transport finished goods to customers and consumers, and manage unpredictability in the marketplace. The ability to leverage logistics partners that can deliver your time critical shipments will be an important element to combat that uncertainty.

Author: Paul Tessy, Senior Vice President, Purolator International

The global pandemic continues to drive uncertainty throughout supply chains, resulting in trade restrictions, supply shortages, logistics capacity constraints, and fluctuating demand for companies. These trends will continue to plague manufacturers and retailers as they struggle to secure raw materials, transport finished goods to customers and consumers, and manage unpredictability in the marketplace. The ability to leverage logistics partners that can deliver your time critical shipments will be an important element to combat that uncertainty.

There are many examples of the challenges that manufacturers face when sourcing raw materials and base components during the pandemic. With numerous companies relying on just-in-time processes to build efficiencies in their supply chain, missing one part of that puzzle can have significant consequences. The most obvious example is the lack of microprocessors available to industries such as auto manufacturing and consumer electronics, which has exposed critical vulnerabilities in their supply chains.

Currently there are record backlogs at several US ports, especially the ports of Los Angeles and Long Beach, California, due to surging demand for imports. These two ports alone are responsible for 40% of imports into the US so there has been a bottleneck effect on rail transportation which extends transit times on top of a stressed network. The knock-on effects of these situations extended lead times which directly impacts pricing and customer satisfaction.

Maintaining strong relationships with suppliers and managing expectations with customers in a proactive way can be an important step to handling this uncertainty. Understanding operational processes and having flexibility in the supply chain to acquire certain elements of production considered mission critical can also be a boon for companies. In fact, a survey conducted by Bain & Company found that 53% of companies are “planning to increase investments in flexible operations.” Meanwhile, 56% say they expect to increase investments in predictive planning and demand forecasting.

Like acquiring raw materials, getting finished goods out to customers and consumers can be challenging these days. Getting goods to market requires that same flexibility in the supply chain, including partnering with solution providers that can adapt quickly.

An outcome of these trends is a clear need for more premium, rapid transportation service options to minimize the impact of business disruptions. Companies are increasing their use of expedited services and incorporating them into existing supply chains as a planned feature and not just an emergency tool. Services like Purolator Mission Critical, which combines existing networks as well as off-network resources, provide ultra-flexible ultra-fast solutions that can be adjusted as conditions warrant. These options include bypassing congested regional hubs and going directly to an end destination using the fastest available air routings. The dedicated Mission Critical teams use state of the art technology to ensure maximum visibility 24 hours a day, including weekends and holidays. For industries like healthcare and industrial product manufacturing and distribution, there is no substitute for the efficiency and peace of mind provided by this level of service.

This uncertainty we are seeing in current market dynamics isn’t going away any time soon; companies are quickly learning and adapting to value flexibility and partners who can adjust with them. Selecting a logistics partner that can reliably provide a broad range of express services is vital for success, no matter what new disruption awaits us.

For more information, please visit https://www.purolatorinternational.com.

To Hike or not to Hike? Central banks in the Pandemic Recovery Era

In their article, "To Hike or Not to Hike? Central Banks in the Pandemic Recovery Era"global payment solutions provider, AFEX, who together with Cambridge Global Payments, will be known as Corpay, profiles the actions of central banks globally as policy makers have grappled with keeping both populations and economies healthy. It's a helpful macro look at what's happened over the pandemic and what we might expect.

Author: Jay Brahach , Account Executive & Currency Analyst , AFEX

Since the onset of the pandemic in early 2020, policy makers globally have been grappling with the dichotomy of keeping both the population and the economy healthy. Although preventing the spread of the virus has taken precedence overall, the world’s central bankers have had eyes firmly locked on their respective key policy goals. In most instances this involves a target inflation rate of around 2%, at least in the developed world, as well as a goal of full employment (albeit with less of a mandate to dictate policy).

Global economic activity declined by 6% in 2020, whilst unemployment across OECD countries rose from 5.4% to 9.2%. Lockdowns have resulted in labour force disruptions, particularly within the services sector leading to approximately 30 million workers being displaced across 2 months in the US alone. Supply chain disruptions on the other hand, have lead to soaring commodity prices and stunted delivery times. Lumber for example reached a high of $1,611 USD per tonne in May 2021 compared to around $350 USD in early March 2020.

At the onset of the Pandemic, both the Bank of Canada and the Federal Reserve slashed rates from 1.25% down to 0.25% in order to stimulate economic activity as much as possible. In addition to rate cuts, central banks responded by increasing their respective asset purchasing programmes, aimed at encouraging lending and investment. The European Central Bank introduced the Pandemic Emergency Purchase Programme (PEPP), in which it initially pledged €750 billion in asset purchases, which was increased to €1.85 trillion by the end of 2020.

Almost two years on, as vaccination rates continue to rise and economic activity begins to heat up, central bankers are shifting from a mindset of damage control, to pandemic recovery mode. It is a precarious path, riddled with shifting public policy and a virus which is still causing havoc across large segments of the global community. The question is, what is the best path forward, and who will set the precedent for the next round of policy changes?

In August 2021, South Korea (i.e., via the Bank of Korea) was the first major economy to make the decision to raise interest rates. This may in some part be due to the nation’s decisive action in dealing with the pandemic, which has led to a comparatively faster recovery. The Bank indicated that it was ready to raise rates to 0.75% back in May of this year, however a partial lockdown had delayed this by a few months. The need for this increase was largely down to rapidly increasing household debt, with the bank aiming to curb inflation. This is an interesting move as it may cause other central banks in the Asia-Pacific region to bring forward its rate increases, with the Reserve Bank of New Zealand expected to act next month (provided the economy remains open).

The ultimate barometer for global sentiment tends to be the USA’s Federal Reserve. As USD is the global reserve currency, the denomination in which 70% of world trade is conducted, policy which impacts the USD will almost certainly leads to implications for most of the world’s major economies. At the end of August 2021, the Fed Chairman Jerome Powell delivered the most anticipated Fed speech of the year at the annual Jackson Hole Symposium. When observing these comments, market participants tend to look for two things. When will asset purchases begin to taper, and when are interest rates expected to rise?

Powell expressed that although inflation was a worry in certain sectors of the US economy, it was a phenomenon which was vastly uneven. Durable goods and energy prices alone contributed 1.8% to headline inflation rates with the overall rate at 4.2% as of July. By the same token, prices for services such as hotel rooms and flights have fallen dramatically in that same time period. Powell referred to the inflation experienced as “transitory”, and as a phenomenon which is not an accurate depiction of economic health. Monetary policy takes around 18 months to filter through to the economy, so an ill-timed reactionary rate hike may have negative implications for the labour force in the longer term. Until the US economy reaches maximum employment, and long-term inflation has settled at around 2%, interest rates are unlikely to rise. Market participants have priced in a rate hike by the beginning of 2023, although inflation will be closely monitored in the interim.

From a Quantitative Easing perspective, Powell indicated that asset purchases may be reduced much sooner, potentially by the end of 2021 given strong employment data in July. This could however be hampered if the Delta variant continues to spread and should not necessarily be taken as an indication that interest rates will closely follow suit.

The Bank of Canada has almost echoed the Fed sentiment, taking a largely similar stance as of September 2021. At the beginning of the crisis, the Bank not only cut rates to 0.25%, but introduced an economic stimulus programme committed to purchasing around $5 billion of assets per week. This was cut to $2 billion in October 2020 as the economy had recovered somewhat, but GDP growth in the second quarter of 2021 was lower than expected, with the economy contracting around 1%. Because of the unpredictable nature of this crisis, forward guidance from central banks across the board has been vague, with no firm timeframe given for the ultimate reduction in this asset purchasing programme. The Governor of the Bank of Canada, Tiff Macklem, indicated that depending on economic data and inflation measures, Canada is moving toward a point at which the Quantitative easing measure will no longer be necessary, at which time interest rates will start to rise to combat inflation.

Canada is in a unique position, however, given that 75% of Canada’s exports are sold into the US. The Bank of Canada may not be willing to increase interest rates prior to the US, given the implications for Foreign Exchange markets. A rate hike would most likely make the Canadian Dollar stronger in relation to the US dollar, in turn making Canadian exports more expensive to US customers, not the most ideal outcome in the midst of a recovery.

The European Central Bank (ECB) has indicated as of September 2021 that it will start to taper its PEPP programme, with most market participants expecting it to end by mid 2022. This does not, however, negate its regular asset purchasing programme which was restarted in November 2019. Interestingly, within the European Union, there is an added constraint to this programme, as ECB holdings cannot be greater than a third of each member country’s debt. For Germany, the value currently sits at 30% of overall debt, leaving little room for policy manoeuvre. Moving forward the ECB has indicated that until the QE programme has been reduced to a comfortable threshold, rates will not begin to rise. As with the other banks, there is still ambiguity as to the timeframes evolved, falling back to the mantra of following economic data releases.

The Bank of England has been hit, not only by the effects of the pandemic, but also the economic implications of the Brexit vote. For example, supply chain disruptions experienced across the globe have been amplified by the added frictions caused by Britain’s exit from the EU. In September 2021, the Monetary Policy Committee was evenly split on whether minimum economic conditions had been met in order to consider interest rate hikes. The Governor of the Bank of England, Andrew Bailey, went as far as to say that he was one of the members in favour, although he did not yet think the economy had recovered enough to justify a rate hike. These comments have led market participants to believe that the UK may even precede the Fed in increasing rates, as early as Q4 2022. The bank expects inflation to jump to around 4% and seems willing to pull the trigger on any policy response. This is in conjunction with the reduction in asset purchase programme outlined in August of this year.

The discussion thus far has been focused on policy responses across developed economies. Developing and emerging markets have witnessed even more devastating impacts from the events of the last two years. Price increases have led to soaring annualized inflation rates with Brazil expecting 10.3% by the end of this quarter, 6.7% in Russia and 5.59% in India.

Whilst much of this inflation is similarly transitory in these countries, in practice, market participants do not behave in the same way. This is because in the real economy, inflation expectations are just as important as realised inflation. In G7 countries, it is generally assumed that despite high inflation during the pandemic, as the economy recovers, we will get back to normal inflation levels and price stability. In emerging markets however, there is a more recent history of high inflation leading to lower confidence, and in turn higher inflation expectations. As a result of this public perception, there is greater impetus for these economies to raise rates sooner. Brazil has already raised rates four times this year, whilst Russia, Mexico and Peru have also implemented rate hikes. Whilst these hikes are important to rein in inflation, there is a concern that it may slow down economic recovery in these regions. Price increases in these countries would also filter through to developed economies given the global nature of world trade, so they should not be ignored by the G7.

As we enter into the latter stages of 2021, it is clear that the majority of Central Banks across the world are pursuing a policy of asset purchase reduction and are signalling eventual interest rate hikes. The nuances arise when we consider the order in which these policies happen, as well as the timing for implementation. It appears there is reluctance from many bankers to commit to solid timeframes, as there is a consensus that the pandemic could yet throw up a number of curve balls. Compared to a pre-pandemic world, central banks have been less committed to long dated forward guidance and are more willing to change course based on current economic data, and the shifting winds of pandemic recovery.

For more information on the products and services of AFEX - Corpay, please visit https://www.afex.com/unitedstates/

Sources used in researching this article available on request.

What Are Total Rewards?

Our newest member organization, Canada's largest independent benefit consulting firm, Sterling Capital Brokers, examines company rewards programs with a firm's top talent in mind in "What are Total Rewards?". As companies compete for employees in an environment where expectations on where and how we work and how to strike a work-life balance continue to evolve, SCB shares some of the top priorities and key considerations for engaging your employees as you define and communicate a Total Rewards strategy in your firm.

A total rewards strategy is essential in attracting, motivating, and retaining top talent within your organization. They deliver more targeted value to the various employee populations and enhance the overall employee experience, while providing the employer with the ability to attract and retain top tier talent.

Top priorities for 2021 Total Rewards include:

· Optimize while reducing costs of existing programs

· Ensuring compensation plans are competitive

· Wellness programs

· Supporting & educating employees on financial wellness such as retirement plans, stock options etc.

· Group benefit plans including Life Insurance, AD&D, Health, Dental and Vision care

· Paid time off/Personal Day/Flex Time

· Flexible work hours/ Work Life Balance

· Remote work

· Company sponsored training/development

Start by reviewing your current compensation package as salary alone won’t allow you to compete for and retain top talent these days. Reframing your plans as a total rewards compensation including other perks can support you in becoming an employer of choice. Once you have defined your total rewards package, you can use it to illustrate the value while talking with employees and candidates.

Employees must be aware that the benefits exist and be knowledgeable about them to use them properly and to gain their full value. Outlining your program, providing employee education sessions and highlights of benefits and perks will support your education of both current and future employees.

When employees see the value and what you are willing to invest in them, above their pay, it can lead to a positive work culture, improved morale and engagement and higher retention. Employee satisfaction has been shown to lead to better performance, fewer sick days, and higher productivity.

Finally, you’ll need to measure the success of your program and how well received it is by employees. Job satisfaction questionnaires given prior to rewards changes and 1 year following are a good way to measure your results.

Implementing a Total Rewards Strategy is not an easy task, but the rewards far outweigh the risk. You may want to implement a Total Rewards Strategy, but not be sure where to start, who to reach out to, or what the benchmarking is in your area, or industry. Sterling Capital Brokers can support you and your team in defining what Total Rewards means to you and your team. We can provide the insight and expertise required to design a benefit strategy within budget, while supporting all your team’s needs.

For more information, please visit the Sterling Capital Brokers website at https://sterlingcapitalbrokers.com

Northern Nearshoring: Why Canada is well-placed to help diversify U.S. Supply Chains

While businesses had already been exploring the idea of diversifying manufacturing operations away from China in recent years, the global pandemic has put pressure on companies to speed up the process. In recent weeks, similar closures and supply chain disruption have emerged out of China and Vietnam—the latter of which has captured about half of the capital flight from China due to the U.S.-China trade war—and have served as a reminder that global supply chains have not yet reached a true post-pandemic “new normal.”

What manufacturing destination alternatives to China exist? There are a multitude of manufacturing centers across the globe; yet, for U.S. businesses, their northern neighbor might just be their best bet.

Jill Hurley

Director, Global Trade Consulting

Livingston International

For several years, relying heavily on production in China has represented a certain degree of risk to American businesses. Significant challenges with red tape, as well as concerns about government corruption, intellectual property theft, and forced knowledge transfer have hounded U.S. businesses for more than a decade.

The risk of relying on China for production became even more evident with the outbreak of COVID-19, when lockdowns forced the closure of factories and stopped service at key ports, creating massive delays in the production and transport of goods destined for U.S. shores.

While businesses had already been exploring the idea of diversifying manufacturing operations away from China in recent years, the global pandemic has put pressure on companies to speed up the process. In recent weeks, similar closures and supply chain disruption have emerged out of China and Vietnam—the latter of which has captured about half of the capital flight from China due to the U.S.-China trade war—and have served as a reminder that global supply chains have not yet reached a true post-pandemic “new normal.”

What manufacturing destination alternatives to China exist? There are a multitude of manufacturing centers across the globe; yet, for U.S. businesses, their northern neighbor might just be their best bet.

Challenges in Offshoring to China

Since becoming a member of the World Trade Organization in 2001, China has become the world’s factory. Loosened state regulations and access to an enormous, young, and inexpensive workforce made it the perfect destination for manufacturing operations. Over the years, China was able to adapt to new technological changes and manufacture complex products such as electronics and printed circuit boards.

However, China’s rapid growth wasn’t sustainable. The speed and value by which China was able to manufacture products declined as its population grew. As China’s workforce became more skilled, employees demanded higher wages. In addition, and as noted above, the omnipresence of cybersecurity threats, forced knowledge transfer, and intellectual property theft increased the risk of doing business in China.

The ongoing trade war between Beijing and Washington and its widespread tariff barriers further disincentivized sourcing from China. The trade war (and its collateral damage) led businesses in the U.S. and elsewhere to start considering relocating their manufacturing.

Post-Pandemic Offshoring Challenges

As China began recovering from the COVID-19 pandemic in mid-2020, factories reopened and orders began making their way to customers. However, disruptions related to backlogged inland transport and congested ports impeded shipments; a purchasing boom (especially through e-commerce) exacerbated the container shortage. That caused delays in the arrival of goods coming from China to Europe and the U.S.

To mitigate the effect of the container shortage, shippers began investigating the option of air freight only to find it impractical for bulk goods and a costly means of transport.

Ports in the U.S. (especially those in California, which handle half of the ocean traffic from Asia) have witnessed massive backlogs throughout 2021. The National Retail Federation called on President Biden in June to address the logjam at ports.

The container shortage wasn’t the end of the disruption, though. A grounded container ship blocking vessels in the Suez Canal (a vital trade route) in March 2021 further held up shipments. In June 2021, the Delta variant of COVID-19 struck China’s Guangdong, a major shipping hub. To halt the spread, authorities in China shut down manufacturing, once again creating delays in the arrival of goods on U.S. shores.

Experts predict it will take at least a year to recover from the cumulative effect of shutdowns, increased demand for goods, shipping delays, and an exponential increase in the price of shipping. Building a sustainable, efficient, effective supply chain means overcoming these challenges. For many companies, nearshoring manufacturing operations reduces these obstacles.

Nearshoring Considerations

Moving manufacturing operations out of China (or, reducing dependency on China for manufacturing services) is a major step towards improving the resiliency of a supply chain.

Before the pandemic, many U.S. businesses made use of the just-in-time model, which saw goods moved with great precision and punctuality to ensure business continuity while reducing the burden and cost of storage. However, the global pandemic gave businesses pause. “Just in time” became impossible with varying lockdowns around the world. In response, many have begun shifting all or part of their supply chains to a just-in-case model, with built-in redundancies and contingencies to maintain business continuity in the event of production shutdowns or transport delays.

A critical component of the just-in-case model is the use of nearshoring or bringing core production closer to home to ensure greater access to and reliability of suppliers while also reducing time in transit.

However, for businesses investigating nearshoring, it’s critical to consider whether the infrastructure in the new sourcing country supports a just-in-case model.

Many U.S. companies have recognized the importance of the just-in-case model, and have begun investing in Canada, their neighbor to the north. Statistics Canada noted that in the last quarter of 2020, U.S. investment in Canada (including mergers and acquisitions and reinvested earnings) reached $4.8 billion—a major increase from Q4 2019, in which U.S. companies invested $656 million.

These investment trends reflect sentiments among U.S. executives. Research from PwC shows a growing number of U.S. business leaders see Canada as crucial to their growth; between 2019 and 2020, the number of decision makers who believe Canada represents an excellent investment opportunity doubled. During that same time period, the number of executives who see China as critical to corporate growth decreased by 30%.

While Canada offers a number of obvious advantages, such as close geographic proximity, seamless transit and comparable business culture, there are other, often overlooked, benefits behind Canada’s attractiveness as a supply source.

Canada As a Nearshoring Destination

Labor

One of the critical factors for businesses looking to supplement or supplant production in Asia will be labor. This will be particularly true for industries that rely heavily on highly skilled labor. Canada boasts a highly educated workforce, more than one-third of which is made up of professional, scientific and tech-related jobs. The high skills of the Canadian workforce have allowed the country’s manufacturing sector to flourish and become integral to global value chains.

This has not been lost on U.S. businesses, who have been using Canada as a rallying point for value-add production. In fact, prior to the pandemic, the U.S. was the destination for more than half of Canada’s intermedia-goods exports, demonstrating the degree to which America’s northern neighbor had become integral to U.S. supply chains.

Reduced Barriers to Trade

The U.S.-China trade war has resulted in increased landed costs to U.S. businesses (the total cost of importing goods, including duties, taxes, shipping and customs administration). Today, there are few products from China for which tariffs do not apply, resulting in increased cost of goods and reducing market competitiveness. In addition, soaring freight rates have added to the overall cost of moving goods across the Pacific. Then there’s the ever-present risk of sudden and unanticipated shifts in trade policy that could result in the embargo of select goods or goods from certain origins, or an increase in tariff rates.

Conversely, the recent implementation of the United States-Mexico-Canada Agreement (USMCA) ensures goods can move through the Canada-U.S. border seamlessly and duty free (for almost all goods). Moreover, the trade agreement, which was an update to the North American Free Trade Agreement (NAFTA), established greater harmonization of regulatory requirements, reducing the administrative and legal burden associated with moving goods into Canada from the U.S. and vice-versa.

Infrastructure

One of the key challenges for U.S. businesses looking to diversify their supply chains will be finding sourcing markets that offer comparable trade and transport infrastructure to China. Beijing has invested heavily in upgrading China’s seaports, airports, railways and roadways to facilitate its export-driven economy. While many U.S. businesses have shifted production to other parts of Asia, they have discovered the infrastructure in those countries is often inadequate to support the recent surge in trade activity.

Similarly, Canada has put significant emphasis on creating fluidity of transport across the country and across the Canada-U.S. border. Exports account for one-third of Canada’s GDP and imports another third, meaning the facilitation of trade is a cornerstone of the Canadian economy. The Canada-U.S. border, which remained uninterrupted during the pandemic, is the most porous international border in the world.

Moreover, the potential for a merger of Kansas City Southern and one of Canada’s two major rail lines presents the possibility that a truly continental railway network could be in place in the near term, establishing even greater ease of transport. In addition, Canada’s port infrastructure may also be a source of relief for B2B businesses looking to move goods from Asia-Pacific to customers in the U.S. Using a recently introduced program by U.S. Customs and Border Protection, businesses can make use of the more generous threshold for low-value goods incorporated into the new USMCA to ship items from Asia to Canada, before transporting them by ground—and duty free—across the Canada-U.S. border.

Growth Sectors for Canada

A recent report from Invest in Canada, an arms-length Government of Canada organization dedicated to promoting investment in Canada, showed that for foreign businesses, Canada presents particularly advantageous opportunities for firms in advanced manufacturing and clean technologies.

There is a symbiotic relationship between advanced manufacturing and clean tech in Canada. The latter has seen widespread growth and innovation throughout the country, particularly in the energy and resource sector. These emerging technologies will become increasingly in demand amongst U.S. businesses as they move to reduce their carbon footprint and adopt an ESG model (environmental, social and governance).

This is already occurring in the automotive sector. U.S. automakers are now in the process of retooling Canadian production facilities to manufacture electric-powered vehicles. Additional investment is being made by foreign automakers in fuel-cell products in response to Canada’s focus on becoming a leader in hydrogen and fuel-cell technologies.

An editorial in the May 2021 issue of Manufacturing Automation points out that Canada’s advanced manufacturing sector is ripe for investment: 40% of manufacturers use advanced technologies in their processes, and GDP growth in this field rose 3.7% between 2017 and 2019.

Cleantech Group, a San Francisco-based consulting firm in the industry, ranked Canada as second in the world for clean tech innovation. While cleantech is an emerging technology, the robust infrastructure in Canada proves these innovations makes an excellent nearshoring investment.

In short, investment in clean tech is fuelling investment in the manufacturing of eco-friendly products, making Canada a particularly strong locale from which to develop products of the future.

The events of 2020 have shown it’s time for U.S. businesses to build contingencies and redundancies into their supply chains to minimize the risk of disruptions. While China remains a critical sourcing market for many firms, investment in regionalization will create long-term benefits in the form of improved business continuity and sustainability.

Canada’s skilled labor, investment in infrastructure and liberalized trade regime, in combination with its flourishing clean tech and advanced manufacturing sectors and its proximity to the U.S. makes it an ideal nearshoring option for firms looking to diversify their global supply chains.

Jill Hurley brings a wealth of expertise in the development and implementation of import/export compliance programs, compliance audits, export licensing requirements, supply-chain security, the preparation, submission and oversight of penalty mitigation projects and assistance with U.S. trade remedies, such as anti-dumping and countervailing duties, and intellectual property orders.

For more information on Livingtston International and their cross-border services, please visit their website at www.livingstonintl.com. The website includes a 2021 Trade Landscape portal - a resource for businesses looking to better understand the global trade environment (issues, trends, policies, etc.).

Tackling Wicked Problems in Higher Education

Former US Secretary of State George Shultz once drew a distinction between “problems you can solve and problems you can only work at.”These two types of problems have names: they are tame or wicked. Wicked problems are messy, confusing, unstable, ill-structured, and ambiguous.The Maple League of Universities was originally created to solve a wicked problem. The wicked problem was a lack of awareness or understanding of quality undergraduate education in Canada.

Dr. Jessica Riddell

Stephen A. Jarislowsky Chair of Undergraduate Teaching Excellence

Executive Director, The Maple League of Universities

Full Professor, Department of English, Bishop's University

3M National Teaching Fellow (2015)

Bishop's University

Sherbrooke, Québec, Canada

Traditional Territory of the Abenaki, members of the Wabenaki Confederacy

Former US Secretary of State George Shultz once drew a distinction between “problems you can solve and problems you can only work at.”

These two types of problems have names: they are tame or wicked.

Wicked problems are messy, confusing, unstable, ill-structured, and ambiguous.

The Maple League of Universities was originally created to solve a wicked problem. The wicked problem was a lack of awareness or understanding of quality undergraduate education in Canada.

Prospective students, parents, and policymakers were not, for the most part, able to articulate the differences in student experience between a large, comprehensive university compared to a small, primarily undergraduate, rural and residential university.

In contrast, the United States values diverse models of student experience, from small liberal arts colleges to large, state-funded universities. Furthermore, American universities have long recognized the value of collaboration through a consortia approach, whether that is driven by sports, like the Ivy League, regional interests and joint programming like the Five College Consortium, or through the delivery of innovative online courses like the newly founded League for Innovation in the Community College.

Canada tops the list as the most educated country in the world, according to the Organization for Economic Co-operation and Development (OECD). Universities Canada (2019) estimates that there were ~1.4 million students in Canadian universities in 2018: 77% were at the undergraduate level (CAUT, 4.8, 2019). Furthermore, undergraduate enrollment has increased 24% over the past decade (CAUT, 4.2, 2019). For the vast majority of students studying at Canadian universities, undergraduate education is the terminal degree.

Although recent polling by CAUT reveals that “most Canadians believe that it has never been more important to get a post-secondary education,” only 68% of first-year undergraduate students believe that university is worth the financial investment (CUSC 2019).

The cost of higher education, the future of work, and pressing social issues (climate change, poverty, income inequality, food instability, racism, gendered violence) exposes the need to deliver high quality, accessible 21st century education: we must equip new generations of thinkers to tackle wicked problems. The pressure has never been higher, and yet the wicked problem persists.

Students interested in studying at Canadian universities should be able to make informed choices about their undergraduate experience.

"Therefore, in 2012, four Canadian universities – Bishop’s, Acadia, Mount Allison, and St. Francis Xavier – decided to collaborate on this wicked problem. The first Canadian consortium of its kind, in 2016 they formed The Maple League of Universities with a mission to raise the profile of small, primarily undergraduate universities committed to quality 21st century liberal education."

When I assumed my role as Executive Director in 2018, I was inspired by the tremendous potential this collaboration could have on the higher education sector. As I write elsewhere, inter-institutional collaboration is no easy ask: universities are wired to compete when they recruit prospective students, compete against one another in athletics, and compete for funding in capital campaigns and external fundraising. Students compete for grades, academics compete for grants, and departments compete for resources.

In addressing one wicked problem – raising the profile of small, liberal education universities – the consortium created a new wicked problem, which was: how do we rewire our mindsets in order to think carefully and critically about how collaboration makes us all better than the sum of our individual parts?

Over the past three years we’ve made tremendous strides, including attracting over $1 million in funding for high-impact practices and experiential learning, building integrated hubs and innovation networks (across research, teaching, and professional clusters), mentoring students and faculty with national recognitions for educational leadership, and more.

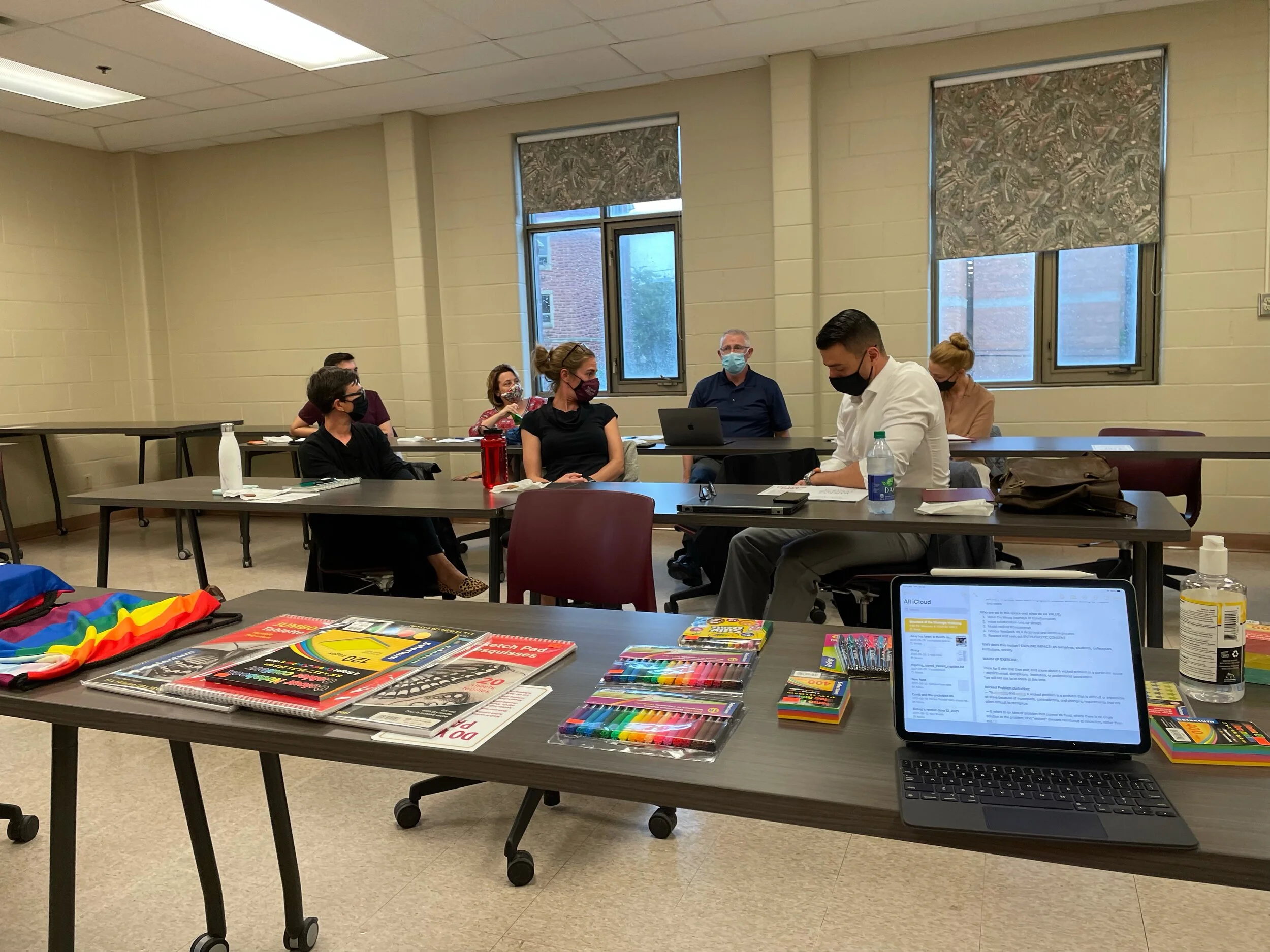

Maple League Teaching and Learning Committee Retreat (top) and Registrars' Retreat (bottom).

However, innovation and institutional change present tremendous challenges. The most disruptive interventions require us, as philosopher Ira Shor urges, to “challenge the actual in the name of the possible.” Disruption, therefore, does not occur without dissonance. The more disruptive the idea, the more likely it is “wicked,” complex, and creates significant disturbance.

To harness disruption in generative ways, I curated a series of wicked problem design principles to guide a new strategic visioning process for 2021 and beyond. These design principles help illuminate some of the challenges and opportunities we face. The concept of wicked problems is not new: Rittel and Webber coined the term in the context of problems of social policy in 1973. And yet, a renewed commitment to solving wicked social problems is essential to fulfilling the moral contract universities have to the broader society.

In the strategic visioning process I have distilled five design principles drawn from a broad range of theorists that I hope are flexible enough for diverse sectors and industries:

1. “A wicked problem is a problem that is difficult or impossible to solve because of incomplete, contradictory, and changing requirements that are often difficult to recognize.” In other words, a wicked problem like climate change or income inequality is overwhelming and hard to even get into focus because the edges are blurry and the shape is constantly changing.

2. A wicked problem “refers to an idea or problem that cannot be fixed, where there is no single solution to the problem.”

This is a frustrating one for those of us who identify as “fixers” because there is no singular approach or narrow intervention. Instead, deep and meaningful impact can only be brought about when engagement is multi-pronged, distributed, combining a grassroots + top-down-supported approach. This means fostering integrated hubs and convergences across disciplinary and professional lines.

"We need individuals with different perspectives and experiences and expertise working collaboratively – including rethinking what counts as expertise and authority outside of traditional paradigms and structures. There are very few organizations who take this approach because co-design is messy and difficult and demands that we break open in order to transform."

3. "Wicked" denotes resistance to resolution, rather than evil.

While it is easier for us to dismiss something as evil, it is much harder to look at where the points of resistance lie and why resolution is difficult. As a Shakespearean, I love this formulation of “wicked”. In Act 4 of Macbeth the 2nd Witch says:

By the pricking of my thumbs,/Something wicked this way comes.

[Knocking] Open locks,/ Whoever knocks!”

[Enter Macbeth]

Macbeth is a truly catastrophic leader guilty of regicide, infanticide, civil war – but he starts off as a husband, a subject, a friend. Macbeth presents us with the wicked problem of tyranny and power and authority; by giving us the shape of the wicked problem Shakespeare helps us navigate our own current political landscapes at home and abroad.

4. Wicked problems are also characterized as having "social complexity [which] means that it has no determinable stopping point".

This means we are never going to get to a point where we can say, “we figured it out!” Instead, hope lies in the “ethical quality of the struggle” (Paolo Freire, author of Pedagogy of the Oppressed). Tackling wicked problems demands that work is ongoing and ever evolving. Furthermore, progress is often really difficult to see – especially in the shorter term. When tackling wicked problems, we have to appreciate that change takes time, but that the hope lies in appreciating (not merely acknowledging) the complexity and the struggle.

5. If those four design principles aren’t challenging enough, a defining feature is that wicked problems beget more wicked problems: because of complex interdependencies, the effort to solve one aspect of a wicked problem may reveal or create other problems.”

This certainly has been the case in the Maple League, whereby the consortium was forged to tackle one wicked problem and exposed a series of other wicked problems in the delivery of accessible, inclusive, and high-quality undergraduate education.

One of the biggest wicked problems we did not anticipate was the global pandemic that shut down the world in March 2020. The rapid changes to our working and learning spaces challenged us to think about how we to live our fundamental values - of wonder and curiosity, respect for human dignity, knowledge and insight - in a world that has been radically disrupted.

COVID has moved our thinking forward in the use of technology, teaching and learning, equity, diversity, inclusion, and accessibility. We have had to harness technology to enhance what we do well – community, collaboration and transformative learning – in virtual, hybrid, and adaptable spaces.

In the midst of this disruption we’ve also returned to the fundamentals: we have come to appreciate, now more than ever, the value of face-to-face and immersive learning environments, the importance of peer-to-peer interactions amongst students, and the necessity of community-building and strong relationships to the citizen towns within which we are situated. We’ve had a stark reminder to value our time together because we know this time is precious.

Online Learning and Technology Consultants program at Mount Allison University (2021).

We’ve also learned that we can go farther together than we can on our own. The universities of the Maple League (Acadia and St. Francis Xavier in Nova Scotia, Mt. Allison in New Brunswick and Bishop’s in Quebec) – all rural, residential, primarily undergraduate, liberal education universities – doubled down on the collaborative approach in COVID, which has fostered resilience across our communities. By engaging with thought partners with similar challenges and hopes, we’ve been able to muster the energy to imagine a sustainable and resilient society.

Some pundits have predicted that the post-secondary sector will be predominantly online or virtual by 2030 – that it will never be the same. They are right that post-secondary education will not be the same after COVID-19, but not in the sense they imagine.

"If there is one basic conclusion that we should draw from our experiences managing the wicked problems the pandemic posed – from self-isolation to working from home, and hours of conference calls – it is that human beings need personal contact and direct interactions with others. Technology and effective pedagogical techniques have the potential to enhance post-secondary learning. We live in a global village which can be much more accessible through technology, even as technology also exposes the wealth gap and growing digital divide."

However, COVID-19 does not foretell the death of the classroom or the physical campus experience in Canadian universities; rather, it reminds us that direct personal interaction is a key component of education and the human experience.

Materials for visioning work at Mount Allison University (2021).

This model of collaborative engagement – in the classroom, within the university, and amongst the four institutions – represents values that are essential to maintaining a civil and just society.

John Dewey, American philosopher and educator, coined the term “creative democracy” in a speech he delivered in 1939 in response to the rise of fascism.

He posits that democracy is a moral ideal continually constructed through actual effort by people; he argues that “the present crisis is due in considerable part to the fact that for a long period we acted as if our democracy were something that perpetuated itself automatically.” Writing in 1939, Dewey’s insights are shockingly relevant to our current global climate.

Dewey concludes, “Since it is one that can have no end till experience itself comes to an end, the task of democracy is forever that of creation of a freer and more humane experience in which all share and to which all contribute.” Democracy itself is a wicked problem, always in perpetual motion and co-created through individual effort and collaborative spirit.

As I grapple with wicked problems, organizations like the Maple League that model collaboration over competition, and value complexity over singularity do not just show us what to do but rather how to be in the world.

The heart of this consortium is to encourage “inventive effort and creative activity” that Dewey believes is required to tackle the “critical and complex conditions of today.” I hope that the next time your thumbs prick because “something wicked this way comes,” you will have a framework for tackling some of our most pressing wicked problems.

For more information on the Maple League of Universities, please visit their website at www.mapleleague.ca .

A Cross-Border Community Fortified by Insight

One of the founding tenets of MAPLE Business Council® is that our members’ and partners’ experience and expertise represent tremendous opportunities for our members to share and learn from one another in service of their strategic planning and business growth. There is strength in community and opportunity in connecting across sectors.

Image from past MAPLE Conversations episode with Debra Lewis-Mahon, Managing Director of Vancouver-based Westmark Tax in Orange County, California.

One of the founding tenets of MAPLE Business Council® is that our members’ and partners’ experience and expertise represent tremendous opportunities for our members to share and learn from one another in service of their strategic planning and business growth. There is strength in community and opportunity in connecting across sectors.

At our in-person and online events we set the table for meaningful networking conversations to occur. And our events, together with our digital content platforms, represent opportunities for knowledge-sharing through presentations, articles and video conversations.

A growing library of expert content

Now as we begin our sixth year, we continue to curate a wonderful breadth of insights to share in our content libraries. We maintain access to the most current 30 articles from our monthly MOMENTUM e-newsletter on our website. Recent articles have addressed northbound private M&A deal considerations, the Southern California innovation ecosystem, the Canadian federal budget, resilient leadership in uncertain times, controlling the speed of patent examination, breaking down the world of SPACs and the internet of medical things.

In addition, we interview our partners. Recent interviews include Khawar Nasim, Acting Consul General of Canada in New York and Nigel Neale, Senior Trade Commissioner at the Consulate General of Canada in New York, U.S. Consul General in Vancouver Ambassador Brent Hardt and John Keisler, Economic Development Director at the City of Long Beach.

We are also grateful for the many members and partners who contributed to our special June issue on Diversity, Equity and inclusion which we published last month. Because of the amount of content we received and our single-minded focus on DEI, we’ve archived these articles on a dedicated DEI Insights page of our website for ongoing reference.

Just push ‘play’…

It’s perhaps even easier to access the content collected in our library of past MAPLE Conversations videoswhich now contains more than 40 episodes of perspectives on an equally broad set of topics with more to be released this summer. With a click, watch targeted 2-minute videos introducing you to a topic and an expert.

And as we all temporarily pivoted away from in-person events because of the pandemic, our webinars have not only connected members and guests from all across Canada and the U.S., something that is simply not possible with an in-person program, but these events have become our latest on-demand content on a wide-range of topics based on webinars we have hosted in Southern California, British Columbia and New York. You can access event recordings on the MAPLE website.

We’re social

While a shared interest in Canada-U.S. economic ties, be it focused on trade, investment or innovation, connects us to one another, our social media channels provide daily updates to inform our work.

We share market and industry news daily on our Twitter channels (@maplesocal and @mapleNewYork) as well as on our Facebook site. Be sure to follow MAPLE on LinkedIn on our Corporate and Group pages for the latest membership and event news.

Subscribing to our Vimeo and YouTube channels ensures you won’t miss any of our Conversations episodes and our on-demand videos of our events.

And earlier this year, we launched a new MAPLE member community channel on Mighty Networks which is a dedicated channel/forum for our members to connect with one another working like our own LinkedIn community channel.

Market resources

You might not be aware of the resources on Canadian markets that are accessible directly from our website. On our Canadian Markets page, you can link to dedicated content on every province and territory in Canada as well as 20 metro markets. Similarly, we have links to major economic development agencies in Southern California.

Together all these platforms keep us connected between our events adding value through information and insight and providing our members with a growing and targeted executive audience to share their work and their perspectives.

So, while your summer reading list may already be filled with the latest thrillers and biographies, I encourage you to tap into the many content channels listed below that are an important dimension of the MAPLE Business Council community and network.

Website

Articles

https://www.maplecouncil.org/momentum

Videos

https://www.maplecouncil.org/maple-conversations

On Demand Events

https://www.maplecouncil.org/webinars

Daily Cross-Border News

Twitter SoCal: https://twitter.com/MapleSoCal

Twitter New York: https://twitter.com/MAPLENewYork

Facebook: https://www.facebook.com/maplesocal

MAPLE News

Instagram: https://www.instagram.com/maplesocal/

Linkedin Company: https://www.linkedin.com/company/3574334/admin/

LinkedIn Group: https://www.linkedin.com/groups/6965520/

Videos

Vimeo: https://vimeo.com/maplesocal

YouTube: https://www.youtube.com/channel/UCgDinVFuD_Jfhqndg-BV4-Q

How Canadian startups can expand internationally by hiring locally in new markets

Hiring local talent in international locations is one of the best ways for Canadian companies to accelerate global expansion, especially in a time of restricted international travel. After all, locals know best how to engage clients in their specific markets. Still, hiring in other countries comes with a lot of red tape, unforeseen complications and potential risks. Enter Communitech Outposts.

Azhar Janjua

Managing Director

Communitech Outposts

Hiring local talent in international locations is one of the best ways for Canadian companies to accelerate global expansion, especially in a time of restricted international travel. After all, locals know best how to engage clients in their specific markets.

Still, hiring in other countries comes with a lot of red tape, unforeseen complications and potential risks.

Enter Communitech Outposts.

Communitech Outposts was first introduced in 2019 to help Canadian companies hire sales employees and foster revenue growth in international markets. Since then, the COVID-19 pandemic has accelerated the trend to remote work, prompting companies to consider hiring a broader range of talent – not just sales people – outside Canada.

Through this program, startup and scaleup organizations can work with Communitech to get the expert, cost-effective help they need to hire top international talent in-market, whether it’s in sales, marketing or R&D.

“COVID-19 has brought the future of work into the present, prompting many companies to take a proximity-optional approach to hiring for the foreseeable future,” said Azhar Janjua, Head of Communitech Outposts. “Communitech Outposts offers a comprehensive level of support for Canadian companies looking to employ remote talent internationally or conduct business virtually, across borders.”

For companies working on their own, the amount of work and risk associated with setting up an international entity to hire talent can be prohibitive. Communitech Outposts removes those obstacles by managing all aspects of employing people in foreign jurisdictions – such as payroll, benefits and statutory filings – enabling companies to access previously out-of-reach talent and enter new markets more quickly, with minimal regulatory risk.

Communitech Outposts grew out of an idea from Dave Caputo, Chair of Communitech’s Board of Directors. Through his previous leadership of Waterloo-based company PixStream, Caputo experienced the headaches that come with international employment. PixStream was able to quickly expand internationally with help from a major investor, who had offices around the world to handle hiring for them. Other companies that Dave worked with did not have such access and had to handle international hiring on their own, resulting in long delays and complications.

“Having a trusted partner who can handle the back-office headaches of international personnel is a huge time and cost saver,” Caputo said. “Communitech Outposts – which can get boots on the ground in weeks – saves companies at least nine months in set-up time while lowering the risks associated with managing employment in foreign countries.”

Communitech has worked with a number of its customers through the Outposts program including Aterlo Networks, an innovative networking products and solutions company.

"We’re a Canadian company, but we have a lot of customers in the United States. Through the Communitech Outposts program, we were able to execute on a strategic US-based hire at a pivotal moment for our business. When we found out the program was run by Communitech, we knew we were in the right hands,” said Gerrit Nagelhout, CEO at Aterlo Networks. “The expertise of the Communitech Outposts team has been tremendously valuable in helping us navigate the costs of health benefits, taxes, regulatory filings and more. In a proximity-optional world, Communitech Outposts is highly recommended for companies looking to hire and expand internationally.”

Through partnerships with business development organizations across the country, such as the Business Development Bank of Canada and Export Development Canada, Communitech Outposts is a one-stop-shop for international expansion that gives customers preferred access to incentive grant and loan programs to facilitate global growth. With this expansion, Outposts is now operational in more than 160 countries including key international markets such as the U.S., U.K., Germany, India, Netherlands, Ireland, France, Australia, China and more.

Interested in learning more about Communitech Outposts? Reach out to outposts@communitech.ca to discuss how this program can help your organization hire and expand internationally.

Northbound Private M&A-Deal Considerations and Opportunities

Northbound M&A activity from the United States to Canada remains robust, fueled largely by optimism for strong economic growth as we emerge from the COVID-19 pandemic, historic levels of government stimulus and incredibly low borrowing costs. Canada resembles the US in its market-oriented economic system, diverse economy and high living standards and the revamped U.S. – Mexico – Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), should facilitate further economic ties going forward. This brief article reviews certain key legal considerations for Americans thinking of buying a Canadian company by way of a private M&A transaction.

Authors: Gesta Abols and Neil Kravitz U.S. Practice Co-Leaders, Fasken

Introduction

Northbound M&A activity from the United States to Canada remains robust, fueled largely by optimism for strong economic growth as we emerge from the COVID-19 pandemic, historic levels of government stimulus and incredibly low borrowing costs. Canada resembles the US in its market-oriented economic system, diverse economy and high living standards and the revamped U.S. – Mexico – Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), should facilitate further economic ties going forward. This brief article reviews certain key legal considerations for Americans thinking of buying a Canadian company by way of a private M&A transaction. For public M&A deals, please see: https://www.fasken.com/en/knowledge/2020/07/ma-guide-acquiring-a-canadian-public-company.

Key Considerations

Private M&A transactions in Canada closely resemble those in the United States and the same key deal points often arise in negotiations. Areas where there are important legal differences include:

· restrictive covenants (which generally must be narrower in scope and time and will not be modified by a court (no so-called ``blue pencil``) to an acceptable level if too broad),

· employment matters (where employment law differs in a number of ways including Canadian protections for workers being much stronger in terms of severance entitlements, among other things), and

· stock based compensation (where options are preferred over profit interests or restricted stock grants in terms of the tax treatment for holders).

In addition, tax considerations can drive transaction structures and often result in a Canadian acquisition vehicle being used to mitigate Canadian withholding taxes and to facilitate a potential tax deferral for management or other Canadian resident sellers. While certain corporate statutes in Canada require Canadian resident directors, options are available to avoid the need to find Canadian resident directors.

Additionally, while the United States and Canada are deeply interdependent in matters of defence and security, the past year has tested the outer limits of the ties which bind our two countries. A short-lived but significant dust-up over personal protective equipment galvanized our understanding that even close cousins will, at times, see to their own essential interests before the good of the other. This reality should not have come as a surprise and will drive the examination of foreign investment approval for some time, with Canada weighing carefully the impact of inbound US dollars on the ability of Canadians to be masters in our own house – especially when times are very tough and critical resources scare. Nevertheless, and without doubt, foreign direct investment will be a key component in Canada’s economic recovery from COVID-19 and even with enhanced scrutiny, US-Canada deals will get done, with proponents working just a little bit harder to convince regulators of the down-stream benefits to Canada — or at least the absence of unmitigated risk.

At a granular level, deal studies reveal some differences between deals in Canada and the United States. The most widely cited deal study is the American Bar Association’s (ABA) Canadian Private Mergers & Acquisitions Deal Points Study, the most recent study having been released just prior to the COVID-19 outbreak in North America. A number of members of the Fasken team were involved in the preparation of the study. Certain differences are set out below.

MAC Definition

Although Canadian definitions largely track those in US agreements, there are some notable differences. First, there are still a surprising number of Canadian deals where what constitutes a material adverse change (MAC) is not defined (down to 10% from 13% in the 2016 study, but still in sharp contrast to the US where it is essentially 0%). Where there is a definition, Canadians are still open to including “prospects” (up to 35% from 30% in the 2016 study, whereas US deals included “prospects” in only 15% of deals). Negotiating “prospects” can get fairly animated, as the seller will want to exclude on the basis that it is too vague and forward looking, giving the buyer an unreasonable right to walk away from a transaction. On the other hand, the buyer wants the definition to capture events or circumstances that have not yet, but may in the future, result in a materially adverse change. Some of the explanation for the difference can be found in the inclusion of more specific forward-looking language in the definition, which is only found in 69% of Canadian deals but 96% in US deals. Forward looking language generally takes the form of including “could reasonably be expected to be” a MAC. Canadians are less concerned about war and terrorism than Americans; a carve-out for such events was included in only 51% of Canadian deals (down from 74% in the 2016 study). Finally, Canadians include changes in accounting as a carve-out from MAC clauses in 41% of deals while Americans include it in 89% of their deals.

Representations and Warranties

The practice in Canada and the US with respect to representations and warranties is largely the same and steady, but there remain some notable differences. It is less common in Canada to include a “no undisclosed liability” representation compared to the US as it is included in only 79% of deals compared to 97%. In addition, where such a representation is included, it is qualified by knowledge in 12% of deals in Canada and only 4% in the US. Oddly, the inclusion of a representation related to compliance with laws fell to 89% from 96% in the 2016 study. It is included in virtually every deal in the US and that was the case in Canada in prior studies. Finally, a Canadian deal is more likely than an American deal to include a full disclosure representation (38% in Canada and 26% in the US, largely unchanged from prior studies).

While still not as prevalent in Canada, the representation and warranty insurance market is catching up to that of the United States. Similar coverage at comparable premiums is available for Canadian M&A transactions with limited exclusions from coverage. The result is that strategic decisions for auction processes in terms of continuing liability of sellers can be quite similar to US deals.

Closing Conditions

There are two notable differences between Canada and the US in terms of closing conditions. First, Canadian agreements are far less likely to include a “double materiality” carve-out in the bring down condition that representations and warranties are true (such a provision is included in only 39% of Canadian deals compared to 87% in the US). Could it be that Canadians agree with noted drafting scholar Ken Adams that double materiality is a figment of practitioner imagination? See https://www.adamsdrafting.com/double-materiality-is-a-figment-of-practitioner-imagination-qed/. The other major difference is that Canadian deals are more likely to require opinions from counsel compared to US deals (18% compared to 7%). That said, Canadian practice would appear to be moving toward US practice as the number of deals requiring opinions dropped in half since the 2016 study.

Sandbagging