Opportunity Zone Funds - An Exciting New Tax Incentive Investment Program

The Tax Cuts and Jobs Act passed in 2017 created as a new federal income tax incentive program, the opportunity zone program, located in Section 1400Z-1 and Section 1400Z-2 of the Internal Revenue Code of 1986. In just the past few weeks, the U.S. Department of the Treasury and the IRS issued much anticipated guidance on many important aspects of the opportunity zone program, which has now moved investors’ and other business stakeholders’ interest in opportunity funds into high gear.

By Garth Stevens and Marc Schultz*

The Tax Cuts and Jobs Act passed in 2017 created as a new federal income tax incentive program, the opportunity zone program, located in Section 1400Z-1 and Section 1400Z-2 of the Internal Revenue Code of 1986. In just the past few weeks, the U.S. Department of the Treasury and the IRS issued much anticipated guidance on many important aspects of the opportunity zone program, which has now moved investors’ and other business stakeholders’ interest in opportunity funds into high gear.

The opportunity zone program is designed to encourage private capital investment in qualified “opportunity zones,” which are designated census tracts throughout the United States that qualify as low-income communities. Opportunity zones have now been designated in almost all states, including California. Various parts of Los Angeles, Orange and Riverside Counties and much of greater San Diego incorporate designated opportunity zones (among many other parts of the state).

What is an Opportunity Fund?

The opportunity zone program provides investors with significant tax benefits for investing in opportunity zones, provided that such investments are made through qualified opportunity funds, which serve as intermediaries between the investors and the particular opportunity zone investments.

An opportunity fund is an investment vehicle that has been organized as either a corporation or a partnership (typically formed as a limited partnership or a multi-member limited liability company), has undergone (or will timely undergo) the requisite certification process, and holds at least 90% of its assets in qualified “opportunity zone property” (as further discussed below). Certification is a self-certification process whereby the opportunity fund attaches IRS Form 8996 to its federal income tax return for the tax year in which the fund first elects to be an opportunity fund and to its federal income tax return for each subsequent tax year. An opportunity fund may be formed to invest in a single project, such as a real estate development or in a qualified entity. However, the opportunity fund may also be formed to invest in multiple different investments.

As noted above, an opportunity fund is required to hold at least 90% of its assets in “opportunity zone property” (described below). An opportunity fund holds opportunity zone property either by directly holding “opportunity zone business property” or by holding stock (treated as equity) or partnership interests in a domestic corporation or partnership, where such stock or partnership interest is issued to the opportunity fund after Dec. 31, 2017, in exchange for cash, as long as such entity is a qualified “opportunity zone business” (described below) on certain testing dates.

In general (and subject to certain other qualifications not mentioned here), an “opportunity zone business” is an entity engaged in a trade or business in which substantially all (at least 70%) of its tangible property owned or leased is opportunity zone business property, and where such entity derives at least 50% of its gross income from the active conduct of a trade or business in an opportunity zone. “Opportunity zone business property” is tangible property used in a trade or business of the opportunity zone business or opportunity fund (as the case may be) that was acquired by the opportunity zone business or opportunity fund (as the case may be) by purchase from an unrelated person after Dec. 31, 2017 and that meets other certain requirements.

Tax Benefits to Opportunity Fund Investors

The opportunity zone program provides three principal benefits to taxpayers who invest in opportunity funds. The first principal benefit is that a taxpayer (by making an election) may defer any taxable capital gain (short term or long term) arising from a prior sale transaction (e.g., a sale of a company or business, or a division thereof, real property or other assets), where the purchaser in such transaction was an unrelated person, by investing all or a portion of such taxable capital gain in an opportunity fund within 180 days after the date of the sale. The amount of the taxable capital gain that is deferred by the taxpayer is equal to the amount that the taxpayer invests in the opportunity fund.

The deferred gain (i.e., the amount the taxpayer invests in the opportunity fund) is required to be included in the taxpayer’s income for tax purposes upon the earlier of (a) the date that the taxpayer sells or exchanges his interest in the opportunity fund or on which the opportunity fund liquidates, or (b) Dec. 31, 2026. However, the second principal benefit of the opportunity zone program is that if the taxpayer holds his investment in the opportunity fund for at least five years prior to the date on which the taxpayer is required to include the deferred gain that the taxpayer invested in the opportunity fund in his income for tax purposes (as noted in the prior sentence), the amount of the deferred gain to be included in the taxpayer’s income will be effectively reduced by 10%; and if the taxpayer holds his investment in the opportunity fund for at least seven years prior to the date on which the taxpayer is required to include the deferred gain that the taxpayer invested in the opportunity fund in his income for tax purposes, the amount of the deferred gain to be included in the taxpayer’s income will be effectively reduced by an additional 5%.

In short, not only can an opportunity fund investor defer paying federal income tax on capital gain from a sale transaction for potentially many years, the amount of capital gain subject to tax, once due, can be reduced by up to 15%. Such gain, when finally taxed, will likely be subject to the investor’s income tax rate in effect at the time such tax is required to be paid. Therefore, when considering an investment in an opportunity fund, thought should be given as to the potential risk of income tax rates rising between the time of making such an investment and the end of the deferral period when the investor is required to pay tax on the original deferred gain.

The third principal benefit of the opportunity zone program is where the taxpayer holds an interest in the opportunity fund for at least 10 years. In such a case, the taxpayer may make an election to increase the tax basis of his investment in the opportunity fund to the investment’s fair market value on the date of a sale of such interest, thereby eliminating any taxable gain on the appreciation of the taxpayer’s investment in the opportunity fund. This is where much of the excitement in the opportunity zone program has been generated because this benefit permits the taxpayer to continue to obtain tax-free appreciation on his opportunity fund investment as long as the taxpayer disposes of such investment on or before December 31, 2047.

Because the above-noted tax benefits are U.S. federal income tax benefits, they should be available to all eligible taxpayers who are subject to U.S. federal income tax and generate capital gains sourced in the U.S., including Canadians who have taxable capital gain from the sale of a company, business, real property or other capital assets in the U.S. (Canadians, as well as other non-U.S. persons should nevertheless consult with their own tax advisors as to how these tax benefits and other aspects of the opportunity zone program may be treated under the tax laws for their own jurisdiction).

Conclusion

The opportunity zone program is an exciting new tax incentive program that aims to promote capital investment in economically disadvantaged communities in the U.S. by offering substantial federal income tax benefits to opportunity fund investors. This article touches only on a few key aspects of the opportunity zone program. The program is subject to many other pertinent details, rules and limitations, as well as continuing development by the U.S. Department of the Treasury and the IRS of further regulations and related guidance. As such, this article should not be construed as a complete discussion of the opportunity zone program. Persons interested in learning more about the program can contact the authors through the email addresses noted below.

Garth D. Stevens (gstevens@swlaw.com) is a corporate and securities partner at Snell & Wilmer L.L.P. and a member of the board of directors of MAPLE Business Council. Marc L. Schultz (mschultz@swalw.com) is a federal tax partner at Snell & Wilmer L.L.P. Both are actively involved in opportunity zone fund formation.

10 Legal Considerations for Marketing & Selling Products in Canada

Despite the talk of trade disputes and the apparent political divide between Canada and the United States the two countries continue to be closely connected in many ways, including with respect to consumers and consumer products. Building your brand and product in the United States in many cases means that you have also built a reputation among Canadians due to the frequent travel of Canadians to the United States and the American media presence in Canada. This creates an ideal opportunity for many companies to launch their products and brands in Canada. While there are many similarities between the countries with respect to marketing and selling to consumers and consumer products there are also many differences.

LuAnne Morrow, Counsel and Trademark Agent - Borden Ladner Gervais LLP.

Despite the talk of trade disputes and the apparent political divide between Canada and the United States the two countries continue to be closely connected in many ways, including with respect to consumers and consumer products. Building your brand and product in the United States in many cases means that you have also built a reputation among Canadians due to the frequent travel of Canadians to the United States and the American media presence in Canada. This creates an ideal opportunity for many companies to launch their products and brands in Canada. While there are many similarities between the countries with respect to marketing and selling to consumers and consumer products there are also many differences. The following are some key issues to consider when launching your product in Canada:

1. Register your Trademarks and Copyrights

Trademark registration is jurisdictional in nature so the trademark registration you have secured in the United States or other countries does not mean your trademark is protected in Canada. A trademark agent can conduct clearance searches and advise if the trademark you are considering or already use in the United States is available for use and registration in Canada. A trademark lawyer can also provide strategic advice with respect to choosing an effective trademark for Canadian consumers. The system for registration in Canada is similar to that in the Unites States but can take much longer so it is advisable to consider trademark registration as part of your launch plan well in advance to selling products in Canada.

If your product has a unique package design or design elements, or is computer software or other work protectable by copyright, registering the copyright in Canada is an inexpensive means for further protecting your product and brand.

Registered trademarks and copyrighted works can be recorded with Canada Customs to reduce infringement, piracy and counterfeit products. Registered trademarks also offer benefits in Quebec where a registered mark is not required to appear in French on packaging.

2. Secure <. Ca > Domains

Although not required many companies choose to use Canadian country code domain names for e-commerce websites aimed at Canadians. It can also be a helpful tool to manage e-commerce directed at different countries. Canadian presence is required to secure such domain registrations and there are options for how to manage such registrations if your company does not have a Canadian store or office.

3. Decide if you will Market and Sell to Consumers in Quebec

The province of Quebec has requirements with respect to the use of the French language when marketing and selling to consumers in Quebec. Making a decision early in your planning process as to whether you plan to sell products in Quebec will inform many other steps you take along the way, such as building your website, terms and conditions for e-commerce, packaging, signage on store fronts, contests and trademarks.

4. Prepare Labels and Packaging to Meet Canadian Requirements

Canadian labelling and packaging requirements are different in several respects from those in the United States. The most significant difference is the requirement for bilingual labelling throughout Canada. In addition the system of measurement is different and will require changes to packages to reflect the metric system. There are also numerous specific requirements for particular classes of products. For example: food products may require inspections or certification both provincially and federally. Use of certifications for organic products must comply with Canadian requirements and nutritional labelling is dramatically different in Canada than the United States. Cosmetics must follow strict guidelines for ingredient lists and alcoholic beverages and cannabis products must meet both federal and provincial requirements and in each province those may differ. All labels must include bilingual ingredient lists and in some cases instructions must also be in both languages and comply with legislation respecting product claims. Companies often engage consults to assist in preparing new packaging and labels, however the consultant should also liaise with legal counsel to ensure the packaging and labelling legal requirements are met.

5. Review Advertisements for Compliance

The principles of ensuring that advertisements are not misleading to consumers are similar in Canada and the United States as are the guidelines for endorsements by influencers or celebrities. However, there are some unique issues in Canada including restrictions in Quebec with respect to advertising to children and restrictions on advertising certain other products such as pharmaceuticals, cannabis, tobacco and alcohol. A campaign that is compliant in the United States may not necessarily be so in Canada. Your advertising agency and legal counsel should work together to review marketing and advertising materials for compliance.

6. Prepare your Website for Canadian Consumers

There are three key issues to consider when making your website and e-commerce sales directed to Canadians: terms and conditions that comply with Canadian consumer protection legislation, a Canadian specific privacy policy, and if you intend to market to consumers in Quebec portions of your website content may need to be in French. Consumer protection legislation exists in all of the provinces in Canada and can impact many elements related to e-commerce and use of websites such as return policies, limitation of liability, and transparency as to changes to the terms and conditions. You may want to consider gating the site to filter Canadian consumers to a separate website or simply integrating Canadian requirements into your content and current terms and conditions.

7. Consider Electronic Promotional Campaigns

Canada’s Anti-Spam legislation (CASL) is far more comprehensive and onerous for companies than the current laws in the United States with respect to spam. Even if your company doesn’t have an office or location in Canada the law still applies to electronic promotions sent to Canadians. These requirements include opt in consent, the ability to unsubscribe from receiving messages and the need to remove names from lists within 10 days of receiving the request, as well as requirements for content and privacy considerations. The fines for failing to comply with CASL are significant and can be in the million dollar range, however compliance is not complex and can be integrated into your current electronic campaigns.

8. Have Contest Rules Reviewed for Compliance

As part of your launch you may want to consider contests, promotions or giveaways. Contests, giveaways and sweepstakes are required to follow specific requirements set out in the Canadian Criminal Code and Competition Act. In Quebec there are additional requirements with respect to contests open to residents of Quebec that including registering with the government authority and posting a bond. If you want to include Canadians in contests that you are running the rules for the contest must meet the Canadian criteria and be communicated in a specific way. Promotional coupons, gift cards and loyalty cards are all subject to provincial consumer legislation and should be reviewed for compliance.

9. Consider Translating Materials into French and other Languages

In Quebec the translation of some materials into French may be mandatory and bilingual labelling requirements are Canada wide. However, from a marketing perspective you may also consider translating promotional materials to French to reach a wider audience in other provinces such as Ontario, and New Brunswick where French is widely spoken or to other languages to market to the very diverse Canadian population.

10. Review your Privacy Practices for Compliance

If your product will be sold through an e-commerce platform, or you will be collecting personal information through your website (including by the use of cookies and other tracking tools), or by other means your privacy policies and procedures must comply with Canadian law. You may wish to consider a policy just for Canadian consumers or integrating Canadian requirements into existing policies.

While the various differences and requirements may appear overwhelming legal counsel with expertise in consumer issues, packaging and labelling and advertising laws in Canada can guide you and work closely with other consultants and your distributor or retail partners to ensure a smooth and successful product launch in Canada.

LuAnne Morrow is Counsel and trademark agent at Borden Ladner Gervais LLP. Her practice focuses on trademark prosecution, strategy and licensing, advertising and consumer issues and she specializes in assisting companies to launch brands, products and companies in Canada. LuAnne is recognized in the 2019 (and since 2010) edition of Best Lawyers in Canada (Advertising and Marketing Law and Intellectual Property Law), the 2018 edition of Managing Intellectual Property's IP Stars (Intellectual Property) and in the 2018 edition (and since 2010) of World Trademark Review's WTR 1000 - The World's Leading Trademark Professionals (Prosecution and Strategy).

Gearing Up for U.S. Tax Reform

It’s hard to believe we are already in the 4th quarter of the calendar year 2018, with the year-end right around the corner. As the year-end approaches, most of us start planning for the winter months and the holidays. It’s also a good time to catch up on personal paperwork and gear up for year-end tax planning in preparation of the 2018 U.S. tax filing season (starting in early 2019).

Taxes may not be the first thing on the top of your year-end to-do list; however, given that the implementation of the “Tax Cuts and Jobs Act of 2017” (TCJA) is right around the corner, it’s a good time to see what you can do now to be prepared and positioned for expected results and no surprises.

Mo Ahmad, Founder & CEO Westmark Tax

It’s hard to believe we are already in the 4th quarter of the calendar year 2018, with the year-end right around the corner. As the year-end approaches, most of us start planning for the winter months and the holidays. It’s also a good time to catch up on personal paperwork and gear up for year-end tax planning in preparation of the 2018 U.S. tax filing season (starting in early 2019).

Taxes may not be the first thing on the top of your year-end to-do list; however, given that the implementation of the “Tax Cuts and Jobs Act of 2017” (TCJA) is right around the corner, it’s a good time to see what you can do now to be prepared and positioned for expected results and no surprises.

Perhaps you’ve read all about the TCJA in the press. If you are still unclear about TCJA changes or how it will impact you, here is a brief recap of the more prominent changes impacting individuals.

1) Decrease in federal individual income tax rates

The individual federal income tax rates were decreased with the top marginal rate moving from 39.6% to 37% starting in 2018. To bolster the good news, the seven tax brackets (or bands) were widened so that more of your taxable income will fall within the lower tax bands resulting in lower taxes for a large majority of us (there are some exceptions for individuals in the higher tax brackets).

For payroll withholding on supplemental wages (e.g. bonus, stock options, restricted share units) a new rate of 22% on $1 million or less of wages and 37% for over $1 million.

2) Increase in the Standard Deduction for 2018

The Standard Deduction was increased to:

- $12,000 for single filers (including married filing separate)

- $18,000 for heads of household

- $24,000 for joint filers

(compared to $6,500, $9,550, and $13,000 respectively under 2017 law)

To provide some background, an individual or married couple can deduct against taxable income the higher of Itemized Deductions or the Standard Deduction.

Taxpayers can now take advantage of the higher Standard Deduction versus having to itemize their deductions. Thus, tax filing becomes simplified as less individuals will have to itemize their deductions. A word of caution, states may still require you to itemize your deductions.

The new Standard Deduction amounts almost doubled; however, the benefit may be offset by the loss of personal exemptions under the TCJA.

3) Expanded Child Tax Credit

The child tax credit expanded from $1,000 to $2,000, while increasing the phaseout from $110,000 in current law to $400,000 for married couples. The first $1,400 is refundable. If a dependent child does not have a social security number, but has an Individual Tax Identification Number (ITIN) then, a $500 nonrefundable tax credit may be available. Other dependents, other than dependent children, may also qualify for the $500 nonrefundable tax credit.

4) New 20% Qualified Business Income Deduction

If you own a sole proprietorship, partnership, or S corporation—known to the IRS as a "pass through" business, you'll see your top tax rate drop to 29.6% for qualified business income attributable to the new 20% Qualified Business Income Deduction. As a "pass through" business, the profits (or losses) pass through to you as the business owner and is reported as personal income. The new tax law excludes some professional services income when certain taxable income thresholds have been exceeded. Professional services can include health, law, consulting, athletics, or financial services fields where the essential asset is the reputation or skill set of one or more of its employees or owners. Professional services businesses involved in investment management, and the trading of stocks, bonds, and other securities for clients are also excluded. How to maximize the 20% deduction is tricky so best addressed by your professional tax advisor who is knowledgeable in how the deduction works.

5) C Corporation changes: Drop in federal corporate tax rates to 21%, new limit on net operating loss carryforward, and more options for accounting method.

If you currently own a pass though, or plan to set up new business in the U.S., you may want to consider a C corporation given the drop in federal corporate tax rates to a flat 21%.

But watch out for the limits on net operating losses, also a new provision for C corporations. When operating cost exceeds revenue on a business tax return, it creates a net operating loss (NOL). The new tax law allows businesses to carry those losses forward indefinitely and use them to offset 80% of their taxable income in a future tax-reporting period. While you can carry these losses forward indefinitely, they cannot be carried back and applied to a prior tax period.

Many small business owners of C corporation that are not personal service corporations prefer the more straightforward cash method of accounting, where you only account for income when the money is received. Thanks to the federal tax overhaul, these businesses with up to $25 million (previous limit was $5 million) in revenue may now stick with cash method of accounting.

6) Full and immediate expensing of short-lived capital investments

For those taxpayers owning a business, there are now provisions for larger and more write-offs. Any qualified personal property you purchase for your business, such as a car, computer, or office space, is now fully deductible for a property acquired or placed in service after September 27, 2017 and before January 1, 2023. For equipment not subject to 100% first year expensing, first year write-offs are increased from $500,000 to $1 million and now includes equipment such as heating systems and home alarms.

7) Elimination of Personal Exemptions

That’s right, you can no longer deduct yourself, spouse or dependents (although, some states allow for personal exemptions). This new provision may have no impact to you if you were in Alternative Minimum Tax (AMT) in 2017 or prior years. Basically, this elimination does not impact you as AMT does not allow for personal exemptions in the first place.

Another mitigating factor that may lessen the impact of the loss personal exemptions is the increase in the child tax credit, and more individuals can now take advantage of the credit due to the increase in phaseout threshold.

8) Changes to Itemized Deductions including mortgage deductions, state and local tax deduction limitation, elimination of miscellaneous itemized deductions.

These changes are significant and will impact taxpayers in especially high tax states and in states who have high property taxes.

The mortgage interest deduction is now limited to the first $750,000 in mortgage loan indebtedness (new loans as of December 15, 2017).

Home equity loan interest no longer deductible

State and local tax deduction is limited to a combined $10,000 for income, sales, and property taxes. Note taxes paid or accrued in carrying on a trade or business are not limited.

Miscellaneous Itemized Deductions are no longer deductible.

9) TCJA changes effective 2019

Alimony is no longer deductible to the payor and not taxable to the recipient (for divorce or separation agreement in effect after Dec 31, 2018).

Mandate of share responsibility payment is reduced to zero effectively nullifying the Affordable Care Act tax penalty.

Recommended Steps and Actions

A tax projection can be prepared to assess all TCJA changes that may be applicable.If you are impacted by the many changes in itemized deductions, it’s generally the case taxable income will go up but the lower tax rates may soften the impact. Moreover, the changes to the 2018 payroll tax withholding tables and the lower 22% tax withholding rate on bonuses and other one-time payments can cause underpayments in tax withholding resulting in potential underpayment penalties and interest.

To reiterate, if you have 2018 state income taxes and property taxes that exceed the maximum tax deduction of $10,000, will this change cause an increase to your federal tax liabilities given that the individual income tax rates are lower in 2018? A projection of your 2018 tax liabilities will allow you to plan for 2018 tax balances due (or refunds) and assess whether estimated taxes need to be paid in or payroll tax withholding increased in the last quarter of 2018 to minimize underpayment penalties and interest.

You may want to consider timing your itemized deductions such as timing charitable contributions.

For example, if a married couple achieves the maximum $10,000 deduction for state and local taxes (state income taxes and property taxes) and mortgage interest of $10,000, it may be wise to stagger charitable contributions between two years. If the taxpayer wishes to donate $10,000 a year to charitable organizations, it would be beneficial for them to pay $20,000 in one year and $0 in the next. Their deduction for the year they made the $20,000 contribution would be $40,000 and the other year they would take the $24,000 standard deduction. If they instead made $10,000 in contributions each year, they would get $30,000 in total deductions for both years. By staggering their contributions, they will have a net gain of $4,000 in deductions over the two years (i.e. $64,000 vs. $60,000 over a two-year period).

If you own a pass-through entity, review eligibility and tax benefit from the Qualified Business Income (QBI) deduction.There may be steps to implement before year-end to maximize the benefit for 2018 and future years as the combination of taxable income, the type of business, and wages can impact eligibility and the calculation of the deduction.The Qualified Business Income Deduction planning should be done prior to the 2018 year-end.

An item to note, taxpayers with international aspects can be affected by other changes in the tax law not mentioned above including disallowance of qualified moving expense deduction and disallowance of foreign property taxes on personal use properties.

Not all TCJA tax law provisions were addressed in this article as it is a highlight of some of the more prominent changes affecting taxpayers. This, coupled with the complexities of new tax law should be reviewed by your tax advisor so planning can be implemented.

Westmark Tax is dedicated to following the impact of the TCJA on your business and your personal tax situation. Feel free to contact Westmark Tax at www.westmarktax.com or (604) 637-9775 with any tax questions.

Is the Stock Market Too Concentrated?

It probably doesn’t come as a surprise that Amazon, Netflix, Microsoft, Apple, Alphabet and Facebook have been some of the best performing stocks in the first half of this year. But what may be surprising is that those six stocks made up 98% of the S&P 500 Index returns for the first half of 2018 according to a recent CNBC article1!

Matt Carvalho, CFA, CFP®, Chief Investment Officer, Cardinal Point Wealth Management

It probably doesn’t come as a surprise that Amazon, Netflix, Microsoft, Apple, Alphabet and Facebook have been some of the best performing stocks in the first half of this year. But what may be surprising is that those six stocks made up 98% of the S&P 500 Index returns for the first half of 2018 according to a recent CNBC article1!

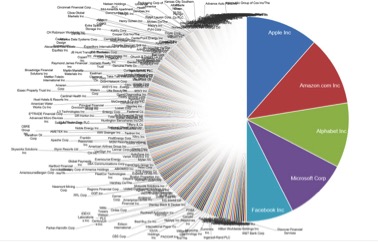

Many headlines over the last year have pointed out just how large these tech giants have grown For the first time since 20002, the tech sector now represents 25% of the S&P 500. When viewed another way, the market capitalization -the amount investors have deemed the companies are worth- of the top (largest) five companies is approximately equal to the bottom (smallest) 282 companies in the S&P 500, as illustrated by the amazing pie chart below created by Michael Batnick of Ritholtz Wealth Management3.

Weight of Top 5 Companies in S&P 500 Versus Bottom 282 Companies

In other words, the bottom 56% of the S&P 500 has the same market capitalization as the top 1%. That’s a lot of companies. Those 282 listed include many household names such as Chipotle, Kohl’s, Clorox and H&R Block, all of which are multibillion-dollar firms on their own. Which begs the question, is it typical for a handful of the largest companies to dominate an index?

It turns out that historically it’s not uncommon for the largest companies to represent an enormous percentage of the index. Today the largest 10 companies represent a little over 20% of the large cap space That’s right about the average we’ve seen over the last few decades, and significantly lower than it was in the 1960s, according to a recent study by Travis Fairchild at O’Shaughnessy Asset Management4. This study also found that on average, about 6-7 of the top 10 names fall out of the top 10 within the following decade, suggesting that many of the current top ten companies will be replaced in the next ten years.

This phenomenon isn’t limited to just the U.S. According to Benjamin Felix of PWL Capital, through July 13th of this year, 75% of the S&P/TSX return came from just 10 of its 246 stocks, led by Suncor Energy, Toronto-Dominion Bank and Shopify5. This may lead you to ask, is there anything I should be doing as an investor to take advantage of this?

First off you should note that well diversified portfolios likely hold all the names mentioned in this piece; Amazon, Apple, TD, etc. are some of the largest holdings for most North American investors. But investing a portfolio solely in those largest companies has two pitfalls - undue concentration of risk and missed opportunities in other areas of the market.

The first pitfall of investing solely in individual names - even some of those red-hot tech stocks, came home to roost at the end of July. Both Facebook and Twitter reported earnings which fell short of market expectations. On July 26th, the day after their quarterly earnings announcement, Facebook fell by a whopping 19%, erasing $120 Billion USD in value! This amount is greater than the entire value of large companies like GE, Nike or Starbucks. A day later, following Twitter’s earnings announcement, that stock also fell 19%. Twitter had been one of the best performing stocks over the previous year prior to that announcement.

While these companies are included in most major stock market indexes, the performance of any individual company is going to be relatively small in comparison to the entire index - for example the S&P 500 was basically flat on July 26th, even with Facebook falling dramatically. But if you owned them individually - they would likely represent a far greater percentage of your overall assets.

Another major downside of only holding those largest of companies is missing out on large potential gains elsewhere. Small companies outperformed their large cap counterparts in the U.S. and Canada significantly over the second quarter of this year. And academic research shows that historically small companies have outperformed their large counterparts over decades6. Yet for the average investor, it’s difficult to not want to go all in on the large gains you’ve recently seen on familiar companies you likely interact with every day.

If outperforming were as easy as picking the recent winners and calling it a day, active fund managers would have a far better track record than they currently do. Yet, the record of both U.S. and Canadian active stock managers is poor, supporting the idea that it’s extremely difficult to outsmart the market and predict in advance who the winners of tomorrow will be.

Like the Apples or TDs of today, or the IBMs or Blackberrys of the past, a few large high-flying companies will often garner the headlines. Yet the key to reaching your financial goals is not the fool’s errand of trying to guess what the wonder company of tomorrow will be, but in keeping a well-diversified portfolio that will own all the companies that may provide that growth.

Matt Carvalho, CFA, CFP® oversees Cardinal Point’s Canadian and U.S. investment management strategy and process. His former role was Vice President, Portfolio Strategy for a $17 billion dollar Turnkey Asset Management Provider or TAMP. While in this role, Matt served with Dr. Harry Markowitz (Nobel Prize winner in economics) and Dr. Meir Statman (expert in behavioral finance) on a six person investment committee offering advice to the TAMP.

Cardinal Point is an independent Canada-U.S. cross-border wealth management organization. Our advisors operate under the fiduciary standard and provide solutions to high-net worth families, individuals, and related institutions. As a respected thought leader, Cardinal Point has been featured and asked to comment on Canada-U.S. planning subjects in over twenty-five publications and videos, including the Wall Street Journal and Globe and Mail.

To learn more, please visit cardinalpointwealth.com or contact us.

1Just three stocks are responsible for most of the market’s gain this year, CNBC, Jul 10, 2018

https://www.cnbc.com/2018/07/10/amazon-netflix-and-microsoft-hold-most-of-the-markets-gain-in-2018.html

2S&P 500 Hits Tech-Heavy Milestone Last Seen With Dot-Com Bubble, Bloomberg, Feb 28, 2018

https://www.bloomberg.com/news/articles/2018-02-28/s-p-500-hits-tech-heavy-milestone-last-seen-amid-dot-com-bubble

3@michaelbatnick tweet, July 18, 2018

https://twitter.com/michaelbatnick/status/1019680856837849090/photo/1

4@tbfairchild tweet, Jun 6, 2018

https://twitter.com/tbfairchild/status/1004375185179529217

5@benjaminwfelix tweet, July 13, 2018

https://twitter.com/benjaminwfelix/status/1017869943226937345/photo/1

6 Common risk factors in the returns on stocks and bond, Journal of Financial Economics 1993

Delivering LA and Southern California to the Global Market - How Does Your Business Plan Fit?

Southern California (SoCal) has a huge business presence globally. It is one of the most vibrant business environments in the world. Los Angeles is the third largest municipal economy in the world. Tokyo is the largest and New York is second. LAX is the 4th busiest airport in the world and the Port of LA ranks as the busiest port in the western hemisphere. This growth of SoCal’s economy brings with it opportunities for businesses from around the world to participate in the building of infrastructure and providing services throughout SoCal. It is an opportunity to gain market share in this culturally diverse region.

Cynthia Coulter, Senior Consultant, ColLAborate

Southern California (SoCal) has a huge business presence globally. It is one of the most vibrant business environments in the world. Los Angeles is the third largest municipal economy in the world. Tokyo is the largest and New York is second. LAX is the 4th busiest airport in the world and the Port of LA ranks as the busiest port in the western hemisphere. This growth of SoCal’s economy brings with it opportunities for businesses from around the world to participate in the building of infrastructure and providing services throughout SoCal. It is an opportunity to gain market share in this culturally diverse region.

Los Angeles will host for the third time the summer Olympics in 2028. While this event alone is not a defining factor for growth, it does provide the opportunity to showcase and encourage the international business community to do business in SoCal.

Unprecedented growth is occurring in infrastructure sectors that need to be improved or built. New subway and transportation systems are being constructed to connect all communities in SoCal. The Ports of LA and Long Beach are becoming world class centers for logistics and trade, while instituting sustainable energy and environmental practices to keep our waterways clean.

Real estate development continues to add more housing and commercial space to keep pace with the neighborhoods where integrating work and home office space becomes more and more attractive.

As always timing and positioning are everything. Businesses wanting to enter this market have to understand the dynamics of doing business here.

Business development, strategic planning, lobbying and public affairs, marketing, and sales have to be integrated. Coordinating these corporate activities is a process for successful growth.

Business development strategies must strengthen longer term values of a company. It is imperative that business leaders in this market share their vision and goals with stakeholders. Through strategic planning, marketing and communications, and lobbying and public affairs efforts--business leadership coming into the market will be building their brand and awareness of their business intentions and goals among stakeholders. Gaining a voice in this competitive and highly energized community requires planning and commitment to the marketplace.

It is a fact, and part of human nature that people love to deal with important people! Being active in organizations that fulfill your business objectives, and where you can interact with prospective clients and other business leaders, goes a long way to being included and accepted as an active, interested participant in the market.

Businesses entering or expanding in this market need to build their presence to increase sales. Attaining these goals may require them to make the decision to bid for contracts with local governments. These bids are large lucrative contracts that include the ports, transportation systems, infrastructure improvements, real estate development, energy delivery systemsand other largescale improvement projects. Effective lobbying and advocacy can afford a corporation lasting competitive advantage. Lobbying efforts are critically important in SoCal. Few activities an executive may engage in carry the potential business impact of a lobbying and communications efforts that reflect the corporate objectives and plans for this specific market. It is the well informed business executive who understands that in today’s climate to win there has to be an integrated business development plan to include strategic planning and lobbying.

Successful business development is dependent on the implementation of strategies building long term value for a company from the point of view of customers (including government organizations and departments) and stakeholders (community organizations, other businesses and business organizations).

It is not easy for international businesses to understand the business and regulatory climate in California. It is complicated. It is based in history that is not always apparent to outsiders.

Professionals who have experience in doing business in California and specifically in LA and SoCal have to have experience and understanding of the global markets. Companies coming here want to know that they are getting guidance, advocacy and business advice that is in line with their business growth objectives. More than ever, the old adage of, “think locally; act globally,” applies.

ColLAborate has its roots in lobbying and public affairs and is known for advocacy, community outreach, entitlement processing, and business to business projects. Since 2000, the partners have worked on some of the most important projects in LA.

Kate Hennigan Ohanesian is founding partner at ColLAborate. Prior to founding the firm, Kate spent more than 12 years serving the City of Los Angeles in various roles, most recently as Economic Development and Legislative Director for Councilmember Paul Koretz. Kate previously served as Senior Policy Director in the Office of Economic and Business Policy for former LA Mayor, Antonio Villaraigosa, where she was responsible for the Hollywood Film and entertainment community.

Cynthia Coulter is a senior consultant to the company who advises on business development opportunities for the firm and brings significant international C-suite experience with a career in international marketing and corporate communications. She is Canadian born, and longtime LA resident who was an executive with California based Fortune 500 companies to successful start-ups. Recently, she worked extensively in the renewable energy/clean tech and sustainability sectors developing successful business opportunities between North America and China.

For more information on ColLAborate, please visit their website, www.collaborate-la.com or contact Cynthia Coulter (cynthia@collaborate-la.com) or Kate Hennigan (kate@collaborate-la.com).

The Riverside County Office of Foreign Trade - An Active Partner to Businesses and Investors

The Riverside County Office of Foreign Trade is an active partner with the multitude of businesses and investors who work in this booming and sprawling Inland Southern California county, and the Office’s many programs this year illustrate the wide array of services and support exporters and investors receive.

The Riverside County Office of Foreign Trade is an active partner with the multitude of businesses and investors who work in this booming and sprawling Inland Southern California county, and the Office’s many programs this year illustrate the wide array of services and support exporters and investors receive.

Agriculture

From grapefruits to garlic, Riverside County farmers have diverse and robust export businesses that send products to more than 50 countries around the globe including Canada, China and Ghana, among many others. Many of those farmers and the businesses that want to work with them gathered for a day of programs and exhibits on trade, technology and more earlier this year.

The Riverside County Economic Development Agency’s Office of Foreign Trade focused the Ag Expo on high-tech tools of the trade like drones and cutting-edge equipment in the picturesque Coachella Valley. The event drew hundreds of people from across the country eager to showcase their agriculture products and connect with the growers in the room.

Those growers remain strong in spite of the many challenges facing agriculturalists, with the total gross value of agricultural commodities topping $1.2 billion in 2017, according to the recently released annual report by the Riverside County Agricultural Commissioner’s Office.

Trade Agreements

Riverside County businesses concerned about the effects of tariffs and trade negotiations on their businesses had an opportunity in August to share their thoughts with Bryan O’Byrne, chief of international affairs and trade policy at the U.S Small Business Administration.

Mr. O’Byrne listened as a farmer, a manufacturer and others shared their concerns about tariffs and the ongoing NAFTA renegotiations. Mr. O’Byrne is able to carry those perspectives back to the negotiating table. The event was hosted by the Office of Foreign Trade in Riverside.

The discussion provided the latest updates on trade policy topics and enabled businesses to provide direct feedback to a senior SBA representative on what would be beneficial to their business as they seek to start or grow their exports.

The roundtable was featured in an article in The Desert Sun:

https://www.desertsun.com/story/money/2018/08/14/sba-business-people-impacted-tariffs-we-feel-your-pain/949910002/

The article noted the Commerce Department’s statistics on this region’s impressive export growth: “In 2016, goods from the Riverside-San Bernardino-Ontario area had an export value of $10 billion, according to data compiled by the U.S. Department of Commerce. Trade in the region grew 144 percent between 2006 and 2016. … Mexico, Canada, and China – in that order – rounded out the Riverside area’s top export markets.”

GoGlobal Export Accelerator Program

In an effort to work with Southern California businesses looking to begin exporting or expanding their exports, the Riverside County Office of Foreign Trade will host an exclusive one-day accelerator program September 12. The GoGlobal Export Accelerator Program will have guest speakers discussing different markets, innovation, business growth through E-commerce and cryptocurrency trade.

This exclusive event will help manufacturers, growers and others who are in need of guidance in the international market realm. With only 20 spots available, businesses will receive focused and highly skilled guidance on how to invest and export from experienced professionals. The event will be located at the Riverside County Business Center, from 8 am to 5 pm. Interested businesses must apply to attend:

https://www.rivcoeda.org/oft/CalendarofEvents/News/TabId/1605/ArtMID/2867/ArticleID/19/Riverside-County-College-of-Foreign-Trades-GO-GLOBAL.aspx

SoCal Business Connect Summit

The Office of Foreign Trade’s annual and highly popular event known as the Procurement, Trade & Manufacturing Summit has been renamed the SoCal Business Connect Summit and scheduled for November 7 at the Riverside Convention Center. Last year’s summit drew attendees from across the state and beyond with more than 900 matchmaking appointments held with major buyers and vendors.

Multiple breakout sessions on everything from international trade to cybersecurity to procuring government contracts filled a jam-packed agenda. Anyone interested in attending, sponsoring or participating in the matchmaking can learn more here:

https://www.rivcoeda.org/oft/CalendarofEvents/News/TabId/1605/ArtMID/2867/ArticleID/18/4th-Annual-SoCal-Business-Connect-Summit.aspx

Los Angeles Chamber Event

EDA Deputy Director Leslie Trainor, as well as Economic Development Manager Michelle DeArmond, represented Riverside County in a private briefing with 40 members of the L.A. Area Chamber’s Diplomatic and Commercial Officers Group.

Patricia Elliott, Consul & Senior Trade Commissioner with the Consulate General of Canada in Los Angeles, was the event’s emcee. Elliott (far right in the photograph) serves as vice chair of the L.A. Area Chamber’s Diplomatic and Commercial Officers Group.

Representatives from the Economic Development Offices of the counties of Ventura, Orange, Los Angeles and Riverside participated in this private briefing to discuss economic development by foreign investment and future trade opportunities. The Diplomatic and Commercial Officers group centers its work around infrastructure where members and trade offices are able to develop their own strategies and programs when it comes to trade.

Vietnamese Delegation from Ninh Binh Province visits Riverside County

Riverside County Board Chairman Chuck Washington and Riverside County Executive Officer George Johnson joined the Office of Foreign Trade for a diplomatic roundtable discussion in June with a delegation from Ninh Binh Province in Vietnam. The delegation representing the Vietnamese Chamber of Commerce, as well as public and private entities in Ninh Binh Province, met with the Riverside County to discuss potential trade opportunities between our two governments.

For more information about the Riverside County Office of Foreign Trade, we invite you to follow us on Facebook and Twitter @GoRivcoOFT and on our Web site: rivcoeda.org/oft

TSX Venture Exchange: An Alternative Financing Option for SoCal Growth Companies

SoCal growth companies looking for funding should consider all capital raising options. While many entrepreneurs tend to only consider the traditional route of angel investors to venture capitalists to being acquired, there are other options that may be a better fit for the company’s long-term growth strategy.

Delilah Panio, VP Capital Formation (Southern California), TMX Group

SoCal growth companies looking for funding should consider all capital raising options. While many entrepreneurs tend to only consider the traditional route of angel investors to venture capitalists to being acquired, there are other options that may be a better fit for the company’s long term growth strategy.

With the introduction of equity crowdfunding and Initial Coin Offerings (ICOs), there are now more financing options than ever, including the public markets. However, in the United States going public means being quoted on the unregulated over-the-counter markets on one end of the spectrum, or completing a large IPO on one of the country’s main exchanges on the other end.

The Canadian capital markets are unique in that TMX Group owns and operates a two-tiered marketplace serving companies from early stage pre-revenue companies on TSX Venture Exchange (TSXV) to multi-billion dollar established businesses on Toronto Stock Exchange (TSX). The idea of going public “early” may not be intuitive to most U.S. companies, but it is an important option worth considering.

TSX is the senior market for larger, more stable companies with a track record. The average financings on TSX fall in the $25-$100M range and have an average market cap of $2.0B. These companies benefit from increased analyst coverage and being eligible for our index products.

For smaller, early stage growth companies, TSX Venture is a unique platform that is tailored to companies of this size. TSX Venture provides financings typically in the $5-$25M range and TSX Venture issuers have an average market cap of $31M.

Recent U.S. Tech Listings

In the last year, several California technology companies have listed and raised growth capital on TSXV.

- Boardwalktech Software (TSXV:BWLK) offers patented digital ledger technology supporting blockchain applications; Based in Cupertino, CA; Raised $10M on its TSX Venture listing in June 2018.

- Nubeva Technologies (TSXV:NBVA) is engaged in developing and selling software related to blockchain technology and cybersecurity; Based in San Jose, CA; Raised $10M on its TSX Venture listing in March 2018.

- Universal mCloud (TSXV:MCLD) is building the next generation IoT platform for asset and smart energy management; Based in San Francisco, CA; Has raised $6M since listing on TSX Venture in October 2017.

For the 2018 Technology & Innovation Mid Year Review, click here.

Going Public Considerations

1. Reason: Does your company have a reason to be public?

Advantages of being a public company include:

- Access to capital for multiple rounds of financings.

- Acquisition currency (i.e. public stock) to acquire competitors, technology etc.

- Diversified shareholder base from a few shareholders with potentially onerous terms to a flat cap table of common shareholders.

- Public shares can be used as a recruitment incentive to attract quality talent.

- Being listed on an internationally regulated stock exchange can provide credibility and exposure, particularly important if working with Fortune 500 clients.

2. Ready: Are you and your company ready to go and be public?

- Management Team: Your management team should be interested and ready to go public, and include a CFO with public company experience.

- Board of Directors: Your company will need a formal board of directors that understands its legal and fiduciary responsibilities as public company directors.

- Audited Financials: Two years of audited financial statements will be required.

- Internal Controls: Your company will need to establish the required financial controls and reporting infrastructure to be public.

- Time for Investor Relations: A significant amount of your CEO’s time will be spent on communicating with current and potential investors.

- Transparency: Your company’s financial information will be public to everyone including competitors, and you and your team need to prepare for that.

3. Requirements: Does your company meet exchange listing requirements?

As a junior regulated market, TSXV uniquely lists pre-revenue companies. Listing requirements are based on financial fundamentals including working capital, revenue and net tangible assets, unlike the U.S. markets which base listing eligibility on share price, market cap and shareholder equity. See the Guide to Listing for more details: www.tsx.com/ebooks/en/2018-guide-to-listing/

4. Reality: Can Canadian investment bankers get investor support (retail and institutional) for your type and size of company in current market conditions?

In today’s market, Canadian bankers are looking for companies raising growth versus development capital. This means that the company has developed a commercially viable product, has early customers or interest, and now needs growth capital for customer acquisition and expansion. Typically, companies raising at least $10M are of interest.

Why Consider a Listing on TSX Venture Exchange?

1. A Source of Growth Capital

Last year, TSX and TSXV issuers raised over $55B, making Canada the 4th largest market in the world for financings… which is impressive considering the size of the Canadian population! Approximately 40% of TSX daily trading originates from outside of Canada (a majority of that coming from U.S. sources), providing access to international investors.

As an alternative to private venture capital, a TSXV listing can provide the benefit of raising small, subsequent rounds of capital. TSXV companies raised $6B in 2017, with an average financing of $4M. These are small public companies… and we like to refer to this market as “public venture capital”, as companies are accessing rounds of capital similar to the typical VC route of Series A, B, and C rounds.

2. Tailored to Small Public Companies

With a 165-year history of financing exploration companies, the Canadian public markets have evolved to support small cap public companies. From the securities commissions, the exchanges, and analysts to the retail and institutional investors… everyone in the Canadian ecosystem understands and embraces small public companies. This is not the case in the U.S. TSXV companies benefit from right-sized corporate governance and reduced time and costs to listing. Listing vehicles like the Capital Pool Company (CPC) program allow growth companies to access the public markets without the high costs and risk of a large initial public offering (IPO).

3. No Longer Just a Resource Exchange

While TSX has historically been known as a natural resource market - given our 165 years financing mining and energy companies - today our stock list is quite diverse. In fact our mining issuers currently account for just 10% of the market cap of all issuers, with other sectors surpassing them.

For the past five years, the number one source of new listings has been tech and life sciences companies (including cannabis). Last year, there were 138 new technology/life sciences listings… and all of the issuers in these sectors raised over $29B.

4. A Platform for Long Term Growth

The key benefit of this two-tiered market is the potential for early stage growth companies to list on TSXV, raise several rounds of capital, and when ready, graduate to TSX. In the past 20 years, over 650 companies graduated from the junior board to the senior board, and almost 40% of current TSX-listed technology companies started on TSXV.

TSX is also a true stepping stone to the U.S. markets. Once a TSX issuer is large enough and relevant enough, it can look to interlist on a U.S. stock exchange. If your end goal is to be listed on Nasdaq, TSXV and TSX are a viable path to get there.

For the growth company that is looking to build a long-term sustainable business that requires ongoing access to capital, TSXV is an important financing option to consider.

For more information, contact Delilah Panio, VP Capital Formation (Southern California), Toronto Stock Exchange and TSX Venture Exchange at delilah.panio@tmx.com

Financial Infrastructure is Key for Crypto Company Success

As cryptocurrencies gain traction toward mainstream adoption and acceptance, companies in the crypto ecosystem must balance an influx of revenue and fast growth with the challenges of building a financial infrastructure capable of supporting their changing needs. Whether they’re a cryptocurrency exchange, a company funded through an initial coin offering (ICO), a platform or technology provider―or any combination of those categories―firms need processes and tools to help them address technological, marketplace and regulatory uncertainty amid rapidly changing token and company valuations.

Scott Schimberg CPA CMA Partner - Armanino, LLP

As cryptocurrencies gain traction toward mainstream adoption and acceptance, companies in the crypto ecosystem must balance an influx of revenue and fast growth with the challenges of building a financial infrastructure capable of supporting their changing needs.

Whether they’re a cryptocurrency exchange, a company funded through an initial coin offering (ICO), a platform or technology provider―or any combination of those categories―firms need processes and tools to help them address technological, marketplace and regulatory uncertainty amid rapidly changing token and company valuations.

Without proven monetization strategies, crypto companies are developing their technology and commercialization plans dynamically while the marketplace and regulatory climate evolve. Like other high-growth startups, most are understandably more concerned with proving their concept, attracting investors and rushing to gain market acceptance than with investing in back-office financial tools. The return on investment of engineering talent, for instance, may be more readily apparent than the ROI of financial systems.

But neglecting financial infrastructure can lead to management and compliance challenges as a firm grows and plans for its near- and long-term future. Companies with more effective financial tools and controls outperform competitors that are unable to overcome their technical debt, develop the appropriate financial and compliance processes, or scale efficiently.

A key to establishing a strong financial infrastructure is adopting a cloud-based ERP platform that provides clarity about your operations while enhancing your compliance and governance framework. Core ERP financial tools improve company performance by providing deeper insights into financial and operational results, and centralizing information to enable faster and more accurate decision making.

Key Questions to Answer

With widespread uncertainty underscoring the crypto ecosystem, building core financial tools improves your ability to meet change head-on, scale effectively and plan for future growth. As market and regulatory pressures change the landscape on a near-daily basis, you have to be able to answer some fundamental questions, including:

- Are you operating profitably?

- How much revenue do you have? And how and when do you recognize it?

- Which financial and non-financial metrics are critical for understanding your results?

- Can you account for equity accurately?

- Can you report financial and performance data to investors and regulators?

- Is the data feeding your financial systems timely and accurate?

- Are you managing your cash efficiently?

- Do you have an effective separation of duties?

- Do you have an effective internal controls framework to reduce the risk of fraud and material misstatement of your financial results?

This challenge is complicated by the fact that the accounting rules for cryptocurrencies are vague at best. There aren’t defined standards for cryptocurrency valuation or accounting, or for paying employees in tokens. There are no clear SEC or IRS guidelines, other than the well-understood concept that fraud is illegal.

Beyond that, there's still very little direction on how crypto companies should define revenue for financial reporting or taxation purposes, report it or recognize it. Without this information, it’s difficult at best to communicate results with employees or investors.

Building a Platform for Growth

To answer these key questions (and address the underlying challenges they represent), companies must develop a financial and compliance infrastructure that meets their current needs while accommodating future growth and increased regulation.

Starting from the basics of developing an idea and setting up a corporate entity, to issuing equity and managing cash, to reporting results to investors and regulators, a firm’s reporting requirements will become more complex as it scales. Cloud-based ERP tools can support a company at each stage of its growth by improving its ability to understand its financial performance and take advantage of emerging opportunities.

For growing companies, cloud ERP solutions offer a number of advantages over costly, complex on-premise implementations, beginning with increased flexibility. Instead of assuming all of a company’s transactions and processes will be housed within the ERP―or forcing companies to adapt processes to meet the ERP’s requirements―today’s cloud-based ERP platforms allow greater flexibility by integrating with other financial or operational tools your company is using.

This best-of-breed cloud architecture allows you to invest in a platform offering the most effective performance for your company today, while preserving your ability to expand and upgrade as your company grows and its compliance needs evolve.

These tools also offer user interfaces and terminology that are easier to understand than their on-premise predecessors. This reduces the amount of time needed for training and implementation―allowing for a stronger focus on your company’s core mission and performance.

Beyond technology, a strong financial infrastructure also means having the right people. Companies that aren’t ready to add in-house accounting staff can consider outsourcing some financial reporting, management and accounting support.

Investing in cloud-based ERP and enlisting support from financial management and reporting professionals are foundational steps that can improve your company’s operating efficiency, financialperformanceand credibility with investors, regulators and customers. This strong foundation will help you successfully weather the inevitable changes ahead.

Learn more about cloud solutions and how they can impact cryptocurrency companies with Armanino.

Scott graduated from San Jose State University in 1991. He became a Certified Management Accountant in 1995 and obtained his CPA certificate in 2002. Scott is a member of the Institute of Management Accountants (IMA). He has held various positions with the Amador Valley Chapter, including President. Scott has a mixture of industry experience and has held positions as Assistant Controller, Controller and VP of Finance. He also has more than 13 years of consulting experience, where he has focused on implementing ERP systems.

Connecting with Canadian e-commerce - Where to Go as Domestic Markets Slow

While e-commerce in the U.S. reaches a stage of maturity and online sales stabilize, Canada is expected to see consistently higher e-commerce growth – especially this year and into 2019.1. Canadians shop more online, they increasingly turn to their neighbor to the south. Last year, 67 percent of our e-commerce shoppers bought from U.S. merchants. That’s 23 percent more than in 2016. How often do they shop? Six times each, on average. And, according to Canada Post’s 2018 Canadian Online Shopper Study, 65 percent of Canadian e-commerce shoppers are planning on buying just as much, if not more, in 2018.

Jamie MacDonald - Director of International Sales for Canada Post

While e-commerce in the U.S. reaches a stage of maturity and online sales stabilize, Canada is expected to see consistently higher e-commerce growth – especially this year and into 2019.1. Canadians shop more online, they increasingly turn to their neighbor to the south. Last year, 67 percent of our e-commerce shoppers bought from U.S. merchants. That’s 23 percent more than in 2016. How often do they shop? Six times each, on average. And, according to Canada Post’s 2018 Canadian Online Shopper Study, 65 percent of Canadian e-commerce shoppers are planning on buying just as much, if not more, in 2018.

If you haven’t yet had the opportunity to plan your strategy for connecting with Canadian e-commerce shoppers, stay awhile. We have the insights. Read on to discover everything you need to know about cross-border growth.

Canadian e-commerce gathers speed

Every year, more Canadians shop online, and they shop more frequently. From Vancouver in the west to Moncton in the east, our enthusiasm shows no signs of slowing. As the market evolves, frequent shoppers become loyal hyper shoppers – many of them millennials. By 2021, online sales are expected to hit over CDN $94.15 billion, while the average online spend will probably grow more than 50 percent by next year.

Using 2017 data from 2,300 Canada Post e-commerce customers, we’ve identified the growth hotspots. E-commerce sales in west coast Victoria BC led the field with an increase of 37 percent. Sales to Ontarian shoppers in Kitchener, Londonand Windsor all climbed by more than 30 percent.

Plus, Canadians are the biggest cross-border online shoppers in the Americas. According to a 2016 Paypal Ipsos study, 59 percent of those surveyed shopped both at home and abroad in the previous 12 months.2

Selling to Canadians is the smart way to grow a resilient business

Here are just a few of the reasons why it makes sense to expand internationally by selling into an economically stable and trusted market:

It’s easier to build relationships with consumers who know your brands

Not only are Canadians familiar with American brands – through advertising and bricks-and-mortar shopping trips across the border, but they actively follow your brands. This makes it easier for U.S. merchants to build relationships and generate buzz, even before opening a store north of the border.

So why are Canadianssuch international online shoppers?

- Better availability (35%)

- An appealing offer (34%)

- Better conditions, like service or price (25%)

- A broader range of products (21%)

- Better quality products (10%) 3

Canadian customers live close together and are easy to reach

Although Canada is one of the largest countries in the world, most of us live in dense concentrations within 100 miles of the border. As the country’s national postal service, we are one of Canada’s most trusted heritage brands – and the only carrier delivering to all 15.7 million households and business addresses throughout the country. We also have shopper data to share, by category and geography.

Canadian and American shopper profiles are similar

This means you can not only tap into an additional source of revenue, but also take advantage of economies of scale. For example, you’ll have access to English speakers who are high adopters of internet and mobile – and also buy everyday products in significant numbers.

Acquiring Canadian customers

In the past few years, Canada Post has commissioned ethnographic, neuroscientific and generational research to dig deep into how people connect, interact and act on marketing messages at all of life’s stages. These studies reveal the effectiveness of direct mail in driving action and spotlight the intimacy of ritual, the impact of physicality and the power of data-driven relevance. They also spotlight the effectiveness of an integrated, properly sequenced campaign, using mail to prime other media. Direct mail is a compelling way to make email and other digital communications better recognized and received. Canada Post’s Smartmail Marketing™ solutions take all these considerations into account. It’s the scientific way to connect with Canadian consumers on their path to purchase:

- 64% of recipients will visit a website in response to a piece of direct mail

- 43% of recipients ordered a product online because they received a direct mail piece

The power of the home address

So, how do you find Canadian consumers who behave like your best customers at home? How do you reach those people who shop in the category you’re selling? The Canadian postal code is a powerful thing. It’s our version of the zip code, containing significantly rich data on groups of about 20 households – providing you with the insight you need to acquire customers. Postal code data helps you target new customers in Canada with confidence, so you know you’re getting to the right people.

Respectful, intelligent targeting

This Statistics Canada Census data, along with other rich information sources,helps us characterize the type of customer who lives in an area within a neighborhood. And, although we have more privacy restrictions in Canada, they don’t apply to postal codes. So, you can use respectful, intelligent targeting to connect groups of like-minded people with the brands they’ll love.

Birds of a feather

To find look-alikes, you can select and test postal codes that intuitively align with the characteristics of your best customers – using your current data to identify the lifestyle similarities you want to find and pursue. By applying precise data that reflects the Canadian marketplace, you can create a portfolio of marketing solutions that perfectly align with the needs of Canadian shoppers.

To find out more about how to grow your business by marketing to Canadian online shoppers, connect with Jamie MacDonald at jamie.macdonald@canadapost.ca or learn more at canadapost.ca/gonorth. We look forward to seeing you at our presentation during MAPLE’s Fall Events (September 5-6).

1 eMarketer’s Retail and E-Commerce Sales Report, published in December 2017

2 https://www.paypalobjects.com/digitalassets/c/website/marketing/global/shared/global/media-resources/documents/passport-citation.pdf

3 Google and TSN’s Consumer Barometer report

A Solid Logistics Strategy Brings Canada Closer to Your Customers

Faster, more efficient service is a common goal of all businesses that ship to Canada, and this need for speed has been exacerbated in recent years, with the surge in e-commerce shipments heading to Canada. Canadian customers share the same delivery expectations as their U.S. counterparts — shipments should arrive within 2-3 days, on-time, and at little or no cost to the customer. But with an international border to cross, longer distances to travel, and an unknown distribution network to conquer, how could this be done? In fact, tremendous advances have been madeincross border logistics such that U.S. businesses can now reach the Canadian market faster and with more flexibility than ever before. Much of this innovation has been fueled by technology, and some, by looking at things in a new way.

John Costanzo is the President of Purolator International

A few years ago, the manager of a Southern California manufacturing company contacted one of Purolator International’s regional offices regarding the manufacturer’s recent expansion into Canada. Things were going very well, the manager explained. The company had lined up an impressive number of Canadian retailers to carry its products, and sales were quite robust. The problem though — and the reason for the call to Purolator— was that shipments seemed to be taking longer than necessary to arrive in Canada. Was it possible for Purolator to find a way to cut the transit time, and make the overall process of shipping to Canada more efficient?

Faster, more efficient service is a common goal of all businesses that ship to Canada, and this need for speed has been exacerbated in recent years, with the surge in e-commerce shipments heading to Canada. Canadian customers share the same delivery expectations as their U.S. counterparts — shipments should arrive within 2-3 days, on-time, and at little or no cost to the customer.

But with an international border to cross, longer distances to travel, and an unknown distribution network to conquer, how could this be done?

In fact, tremendous advances have been madeincross border logistics such that U.S. businesses can now reach the Canadian market faster and with more flexibility than ever before. Much of this innovation has been fueled by technology, and some, by looking at things in a new way.

My company, Purolator International, is a leading provider of logistics services for shipments moving between the United States and Canada. Since this is our area of expertise, we’ve not only had a front row seat to the exciting changes taking place, but we’ve been behind several of them. I’m happy to share a few experience-based tips that can help ensure your shipments enter Canada as quickly and efficiently as possible.

1. With the right provider, you can shave days from your Canadian transit time. For many years, “standard” service from California to Canada included a stopover at a distribution center — often located several hundred miles off-course. After being held at the distribution center, the shipment would be loaded onto an LTL carrier and make multiple stops before finally reaching the border. That’s all changed.

• Today it is possible to have shipments move direct to the border, with no distribution center layover, and no stops along the way. This is because LTL linehauls now operate regularly in California, with direct service to Canada.

• Route optimization is another tool that helps ensure shipments travel on the most expeditious route. This is a technology-based tool that maps out the shortest route possible, taking into account factors like infrastructure delays and weather issues.

• Consolidation can help reduce freight costs and expedite the border clearance process. By combining several smaller shipments into one larger shipment, a business can qualify for reduced freight charges and, since a consolidated shipment can clear customs as a single unit, the process also helps facilitate the border clearance process.

Taking advantage of these options depends in large part on your logistics provider. A provider that owns its own fleet of trucks, for example, is generally locked into using their own vehicles, and customers’ shipments must fit into a pre-determined, inflexible schedule. But if you use a logistics provider that does not own its own assets, but instead has relationships with many different carriers from which it selects the best option for each customer, you will have a lot more flexibility.

2. Make sure you can reach your customers. It’s also important to understand some important nuances about the Canadian market. The population of Canada is almost 37 million people, compared with California’s population of 39.5 million. But, Canada is the second largest country in the world, in terms of geographic area. Imagine if the population of California occupied the entirety of the United States, with room to spare. That’s essentially the situation in Canada.