Look to the North: The ‘Best Shore’ Solution for Software Quality Assurance and Security Service for the U.S.

Many U.S. based companies realize the value of onshore or boldly stated Best Shore software Quality Assurance (“QA”) and Security services from Canada. Canadians have minimum language barriers, share the same continent, have a favorable exchange rate, stable trade and government environment, and operate seamlessly in the same eastern to pacific time zones. For those who do business in the global community, these simple facts are sometimes unrealized benefits taken for granted.

Bill Klages, Vice President Influencer & Partner Relations, QA Consultants (Los Angeles); Brett Turner, Senior Partner, QA Consultants (Toronto)

Many U.S. based companies realize the value of onshore or boldly stated Best Shore software Quality Assurance (“QA”) and Security services from Canada. Canada presents no language barrier, shares the same continent, provides a favorable exchange rate, offers a stable trade and government environment, and operates seamlessly in the same eastern to pacific time zones. For those who do business in the global community, these simple facts are sometimes unrealized benefits taken for granted. Additionally, there are four key reasons to consider Canada for software QA and security needs: high-quality talent, innovation, cost savings, and ease of doing business.

Talent: Canada’s Skilled Software Engineering & QA Workforce

Canada has a deep mix of computer science talent that has been educated both in Canada and around the world. Various levels of government have invested heavily in research, technology, innovation, and skilled-worker immigration programs for many years. Wages remain constant and employee turnover is in single digits. Compare this to offshore outsourcing where wages are growing 20% a year and employee turnover surpasses 80% in some skill levels and sectors. The depth of talent and lack of turnover nurtures deeper and more continuous client service. This leads to a cycle of ongoing efficiency gains, greater innovation, less process disruption, and keeps training costs low. The Canadian community of accomplished software engineers and technology professionals is highly skilled, consistent, and committed to excellence. This means better output for clients, lower costs, and fewer headaches.

Toronto, Montreal, and Vancouver are among the top 15 cities in North America (Toronto is #3) when it comes to leading tech talent. Toronto has been hailed as the new up and coming ‘Silicon Valley’. In fact, Toronto beat out Silicon Valley for the number of jobs created, according to the 2018 CBRE report. The city attracts talent with STEM degrees and over 40,000 new STEM graduates every year. This growth is just the tip of the iceberg. Toronto’s surge in tech opportunities has created a ripple effect with the University of Toronto announcing plans to build a new 14-story innovation center that will devote 250,000 square feet to startup companies. This is just one of the many innovation incubator/accelerators around the city that help push Toronto’s tech scene forward.

Toronto is home to one of the most diverse populations in North America with over 51% of the city’s population being foreign-born. Especially, with Canada’s Express Entry visa program, it’s easy for software professionals to immigrate and avoid the H1-B visa crackdown and caps jeopardizing talent availability in the U.S.

Every company’s Achilles heel is its ability to attract and retain top talent. Companies rely on having sufficient qualified workers with little geographic friction. Countries like the United States practice restrictive immigration policies that all but force companies to search for outside contractors. The paperwork alone is a burden in itself. “Today, 81 percent of the full-time graduate students at U.S. universities in electrical engineering and 79 percent in computer science are international students,” according to a National Foundation for American Policy analysis. (Forbes.com 2018/04/02)

With H-1B visa access becoming more restrictive, more companies are finding roadblocks at every turn. Some companies have relocated their entire IT departments overseas, but at what cost? Such an initiative can have massive repercussions internally and externally. Canada doesn’t have caps and limitations on technology resource migration that have strapped the US. Canada is an obvious choice for migrants and foreign talent who wish to begin or continue a career in North America.

Innovation

Toronto is a rising star in terms of technology and the city can barely keep up with the demand for office space. According to Patrick Fejér of B+H Architects, “10 million square feet of new office space is due to open by 2024, more than was built from 1992 to the present. Toronto has more than 120 construction cranes in the air, compared with 65 in Seattle and 35 in New York.” With all that demand for space, innovative centers/clusters have spread outside of the Greater Toronto Area.

In Oshawa, the Ontario Tech and the Automotive Centre of Excellence (ACE) has become a hub of innovation and further study autonomous and connected vehicles. This dedicated facility focuses on vehicle operating systems, mobility device compatibility testing, model-based testing, cybersecurity, lidar and computer vision, and safety-critical systems. Through government funding and its cornerstone clients, ACE staff, many of whom are PhDs, and Master students are working to develop better and more efficient ways to validate this critical software’s quality and compatibility. By using cutting edge technology, proprietary tools, and project management methodologies, innovative solutions are constantly being deployed in a timely and efficient manner.

Waterloo, home of BlackBerry, has created the Toronto - Waterloo Region Corridor, which calls itself “a global center of talent, growth, innovation, and discovery. Rivalling the best in the world, this 100km stretch is the second largest technology cluster in North America.” Startups and multinational companies from around the world are investing and scaling up. The area claims 15,000 tech companies, 200,000 tech workers, and 5,200 tech startups.

The Canadian government is also stepping in to help support innovation through the Innovation Superclusters Initiatives, which is investing up to $950 million to support business-led innovation superclusters with the greatest potential to energize the economy and become growth leaders. According to the Canadian government, “This initiative is a first of its kind for Canada, fostering stronger connections—from large anchor firms to start-ups, from post-secondary institutions to research and government partners—and opening the door to new forms of industry partnership. It represents a significant commitment to partnering with industry and supporting the success of leading domestic and global companies that choose to innovate in Canada.” When it comes to innovation, Canada is a strong contender willing to put in the funding and effort to become a world-recognized leader.

Cost-Effectiveness

Turnover and rapid wage growth have increased the expense of offshore (Asia) technology delivery services. On top of this, travel budgets, relationship management, and physical, linguistic and cultural differences have proven to ominously increase project output outlays. These hidden charges are not adequately planned for, and even when they are, it is like a home renovation budget, the finished product often requires double the initial estimate. When considering budgets, IT leaders must look at the entire picture. Inefficiencies in the offshore model can be upwards of 20-30%. On top of that, consider the exchange rates: The Canadian Dollar is at .76 USD today. This roughly translates into a 24% savings for U.S. clients. By working with Canada, software delivery expenditures can be lowered considerably!

Canadian Dollar plus Innovation & Efficiency minus Offshore Issues and Hidden Costs equals Quality, Cycle Time & Budget Savings

Ease of Doing Business

Location, location, location! Toronto is just an hour plus plane ride away from New York, Boston, Philadelphia and Chicago. The average plane flight from US Western cities is less than 4.5 hours. The flight time to Bengaluru, India is approximately 16 hours! With offshore companies, at best, there are just a few hours of overlapping working hours. In a world where instant communication is vital this type of lag can be debilitating. In fact, the ability to make use of inter-office unified communication and collaboration tools makes the near-shore advantages of Canada even more prominent. Compared to cross-border U.S./ Canadian teams, in-person meetings can happen in just one day. Many clients leave home in the morning able to return that evening. This nearness makes all the difference in rapid enterprise software deployment. Proximity builds relationships, increases efficiencies, lowers engagement time, and keeps travel time and expenses to a minimum.

In summary, the software development cycle entails large budgets and massive responsibilities. Having a partner that is in the same time zone, is highly flexible, is easy to communicate with, and that can respond lightning fast is a major factor in making outsourcing successful. Why look to source outside of North America? Why go to another country when there’s a viable option right next door? If you are considering building and testing software or outsourcing your IT functions, Canada is a compelling option. You will tap into a world class technical workforce, experience innovative infrastructure and solutions, reduce your costs significantly and experience the ease of doing business with your partners to the North.

For more information, please visit www.qaconsultants.com.

A Conversation with Thierry Weissenburger, Consul and Senior Trade Commissioner - Consulate General of Canada in Los Angeles

This month we have the special pleasure of interviewing Thierry Weissenburger, Consul and Senior Trade Commissioner at the Consulate General of Canada in Los Angeles. Thierry recently moved to Southern California to lead the work of a 16-member trade commissioner team based in LA and San Diego responsible for the Southern California, Arizona and Nevada territory. Thierry brings a wealth of experience to our region including past leadership roles for Canada in Northern California, Boston and Ottawa.

This month we have the special pleasure of interviewing Thierry Weissenburger, Consul and Senior Trade Commissioner at the Consulate General of Canada in Los Angeles. Thierry recently moved to Southern California to lead the work of a 16-member trade commissioner team based in LA and San Diego responsible for the Southern California, Arizona and Nevada territory. Thierry brings a wealth of experience to our region including past leadership roles for Canada in Northern California, Boston and Ottawa. In our interview, Thierry shares some of his incoming perspectives and profiles the work of the Trade Commissioner service on behalf of Canadian businesses and those interested in investing and expanding into Canada.

1. Welcome to Southern California, Thierry. How well do you know this region already - either personally or professionally?

In fact, I am so glad to be back to California after an interim period of 7 years. I have had indeed the pleasure to serve in the same Senior Trade Commissioner capacity at the Consulate General of Canada in San Francisco between 2007 and 2012. For our family this was clearly an unparalleled experience and for me a very a rewarding part of my career at which time I learned so much. I realize that Southern California has distinct cultural and market differences, so I would not pretend I know the region that well. I am still very much in a discovery mode, which is always the most interesting period when taking up a new posting.

2. As Head of the Canadian Trade Commissioner Service (TCS) in Southern California, Nevada and Arizona, what is the span of work that the TCS team undertakes for the benefit of those who may be less familiar with the department?

To put it simply, our job as Trade Commissioners is to help grow Canada’s economy in direct service and funding support to Canadian businesses and communities. We are connecting international market players to Canadian business, innovation and investment opportunities, using our network of close to 1000 Trade commissioners in 161 cities around the world, our teams being usually embedded in Embassies and Consulates. In the Southwest, our team of 16 trade commissioners operates from Los Angeles and San Diego and provides services to Canadian clients in virtually all sectors.

However, the Southwest market offers specifically more opportunities and generates higher client demand in sectors such as the creative industries, information technology, the bio-pharma industry, cleantech and infrastructure, aerospace and defense as well as the broader innovation and venture area. We are naturally concentrating our efforts towards these themes as we develop our programming, while leveraging numerous partnerships along the way with Canadian provinces, economic development organizations and trade associations in Canada and locally.

We also manage an active investment attraction program whereby we approach fast growing businesses located in our territory to present them with a compelling “Invest in Canada” value proposition, as well as to support their expansion.

Finally, we work as one team with other members of the Consulate, whether the Consul General, our Honorary Consul in Arizona, or our political and immigration colleagues as we share the common objective to grow the economy and prosperity of Canada.

3. In the time you have spent already at the Consulate General of Canada in Los Angeles, what are some of your initial impressions with respect to Canadian – Southern Californian (SoCal) business ties?

I have been in Los Angeles now for approximatively 3 months and have already experienced the visits of several trade delegations in our territory and talked to numerous clients. Needless to say that our clients’ interest is considerable and that the Southwest is a key market for Canada.

Numbers speak for themselves: Two-way trade in goods alone between California/Arizona/Nevada and Canada is more than $40 billion annually, not counting a very healthy trade in services and tourism.

Canada’s investment footprint is massive, although not always very visible, and concentrates in the financial sector, real estate, entertainment, and other services. As important, the SoCal market is a source of inspiration and a place for Canadian businesses to spot early emerging market trends, progressive regulations and business opportunities – this is particularly true in cleantech, mobility, entertainment industries and media, as well life-sciences.

I should add that Canada has a particular card to play in this market where we have so many friends and accomplished fellow Canadians. I cannot remember a place I visited since I arrived without at least a couple of Canadians: California seems to me like the lost province! Many of them share the desire to stay connected with fellow entrepreneurs and communities at home and to help out if provided with the opportunity.

4. Having represented Canada in markets such as Denmark, the Bay Area and Boston how have you seen businesses best utilize the resources of the Canadian Trade Commissioner Service?

While many businesses in Canada see the Trade Commissioner Service as an organization which organizes trade missions and operates at a very transactional level, clients who have been working with us for a long time appreciate our customized and individualized services.

Engaging in a strategic relationship over a long period of time and in multiple markets is probably where we add the most value to clients. This allows us to understand in more depth the needs of a particular client, build necessary commitment and mutual trust, hence supporting more purposefully the client's business growth around the world. This is certainly an approach that we will amplify over the next years, building on successful experiments I had the pleasure to develop with many colleagues, such as the Canadian Technology Accelerator launched in the Bay Area 10 years ago, or more recently, the management of high-impact clients through Key Accounts Managers.

5. At what stage should a business be at before seeking to engage the help of the Trade Commissioner Service team? And when they’ve reached this level, what is the best way for them to connect?

Typically, TCS works with “export-ready” clients. This statement however can be subject to numerous interpretations and variations depending on the sector, the maturity of the industry, the experience of the founder, company growth rate, let alone that a number of our clients actually do not export anything and rather need to access money, talent, inspiration, partnerships or technology available abroad to grow their company. So, there is clearly an element of judgment, placing the client’s best interest in the middle of the equation. Coming to a market too early and unprepared may be too risky and detrimental to the client’s best interests. Likewise, waiting too long until the product is perfect and has been sold in a few places in Canada could be too late either for competitive reasons or because the market actually does not need it.

The TCS has a no-wrong-door policy, meaning that our clients can reach us either in Canada or directly at our missions abroad. However, if new to the service, I’d recommend clients to contact first one of our regional offices and discuss the best course of action for their international business expansion.

6. Without necessarily getting into any sector specifics, what might a Southern California business seeking to expand internationally be surprised to learn about what Canada offers as a market opportunity?

Since you kindly invite me, I’ll give you what I believe are Canada’s key selling points for investment:

Highly skilled talent: Canada is the most educated country in the world with over 55% of Canadians having graduated from post-secondary institutions, among whom are 2.8M graduates in STEM. If specialized skills cannot be found, investors can quickly bring in top international talent through the Global Skills Strategy. For example, through the Global Talent Stream, eligible workers can receive work permits in as little as two weeks.

Global market access: Canada is the only G7 country that offers investors preferential market access to over 1.5 billion consumers in 51 countries. We have signed trade agreements with top trading blocs: we are partners with the US and Mexico in the USMCA (formerly NAFTA) and we signed the Canada Europe Trade Agreement (CETA), and the CPTPP (between 11 countries in the Asia-Pacific region). The latter two regions do not have yet a similar agreement with the US.

Transport infrastructure: Canada is well placed to serve as a central hub for global trade. Our air transport infrastructure is the best in the world and our coastal ports provide direct maritime access to Asia, Europe and South America. The Great Lakes also provide easy access to the U.S. interior. Combined with secure trade corridors and gateways, our infrastructure facilitates continual supply chain and business operations.

Lower costs: Canada has the lowest overall tax rate on new business investment and lowest business costs in advanced manufacturing and corporate services among G7 nations. Our public health care system also clearly confers a cost advantage to businesses established in Canada.

Innovation: Scientific Research and Experimental Development Program (SR&ED) - Canada’s largest R&D tax credit program provides billions in tax credits and incentives to businesses conducting R&D in Canada. The Strategic Innovation Fund bolsters business investments in Canada's most dynamic and innovative sectors by supporting business activities such as R&D projects, Firm expansion, Attraction of large-scale investments, Collaborative R&D and technology demonstration projects. In addition, the new Innovation Superclusters Initiative connects businesses, academic institutions and not-for-profit organizations to generate bold ideas, drive economic growth, attract top talent, advance innovation and transform regional ecosystems.

These core assets and incentives definitively produced an impact: At a time when foreign direct investment (FDI) flows into developed economies dropped 40%, FDI into Canada increased 70% in 2018.

7. The Canadian diaspora is large and multi-faceted in Southern California with social expatriate associations, business networking through MAPLE Business Council, and simply a large number of Canadians living, working and growing businesses here. What kind of benefit does this ‘Canadian mosaic’ in Southern California offer Canadian companies interested in doing business in the region?

As alluded to earlier, this massive and largely untapped Canadian diaspora in Southern California is a terrific asset for Canada if activated. I have seen it working very well with volunteers from the C100 in the Bay Area or in Boston with the CENE, providing mentoring to promising Canadian entrepreneurs from hard learned lessons. In both cases, these activities were symbiotically aligned with the Consulate’s support to Canadian entrepreneurs, adding a credible and high-value advisory service to the existing suite of TCS services, and in many cases making a huge difference in our clients' success in the market and beyond. There is no reason this approach cannot be deployed in Southern California as well.

8. We have a vibrant wellspring of innovation in Southern California with many innovation nodes nurturing start-ups and new ideas. Given your experience connecting Canada with innovation centers in Silicon Valley and Boston, to name a couple, what has struck you so far about the innovation ecosystem here in Southern California?

I confess that my perspective on that is highly conditioned to what I have been exposed to so far. I witnessed remarkable innovative ideas and marvels of engineering in areas as diverse as the space business, high-speed transportation, biotech, and the creative industries. This being said, I have been particularly impressed by the current public and private sector drive towards building smart cities, mobility (people and goods), and overall considering the sustainability of our infrastructures. Several Canadian companies are active in the market offering their solutions, for example, supporting the transition to carbon free transportation. Facing daunting challenges, this is clearly an area where the Greater LA region in particular is investing a lot of resources and ingenuity. As goes the saying, necessity is the mother of invention!

9. From a personal perspective, what are you most looking forward to about living in the Los Angeles region?

Meeting all Canadian Hollywood stars and learning how to surf of course (smile)…and if I still have some time left, discovering the local wineries and the outstanding LA food scene.

Thierry - thank you for sharing your perspectives and for making Los Angeles and Southern California your new home.

Welcome/Bienvenue!

What’s Happening to the US Public Markets? Why US CEOs Should Look North for Capital.

With the disappointing performances of recent IPOs including Uber and Lyft – both share prices have fallen significantly since their debut earlier this year – and the failed IPO of WeWork, US companies are left wondering if going public is still a viable funding option.

By Delilah Panio, Vice President, US Capital Formation, Toronto Stock Exchange and TSX Venture Exchange

With the disappointing performances of recent IPOs including Uber and Lyft – both share prices have fallen significantly since their debut earlier this year – and the failed IPO of WeWork, US companies are left wondering if going public is still a viable funding option.

Once upon a time, the US public markets were open for business for small cap IPOs. Companies such as Microsoft and Apple went public with public offerings less than $100M. Today, the average IPO is around $250M and the number of IPOs are fewer and fewer. In 2018, there were 190 initial public offerings (IPOs) in the United States. While this was an increase from the past few years, it was half the number of twenty years ago, while the Dot Com bubble was forming.

Despite the introduction of the JOBS Act in 2012 which was meant to reduce regulatory burden and costs and to facilitate capital formation, US companies are staying private longer. The average time from first financing to IPO has increased from 4.8 years in 2005 to 6.6 years in 2019.

Investors backing these high growth companies – venture capitalists and private equity firms – are choosing to keep their portfolio companies private longer and tapping into more private capital sources for growth. This trend has several consequences that have an impact on the US entrepreneurial ecosystem and overall economy. When a company stays private longer, fewer people end up cashing in on these great American growth stories. If a company goes public earlier, the public has the opportunity to invest in and benefit from the upside as the stock grows. Today it’s often the VCs and PE investors that win.

The benefit of stock option plans to company employees is also impacted when the company stays private longer, as they are not benefitting from vested options along the way to buy homes or pay off debt. The big windfall of the IPO is less likely to happen now.

And, these companies are also not benefiting from the corporate governance regime that creates discipline especially on fiscal management. When a company goes public, it is required to have audited financial statements and a board of directors with an audit committee, as well as conduct quarterly reporting… all of which ultimately benefit the company and its growth.

North of the border, the Canadian capital markets are tailored to early stage companies seeking growth capital. TMX Group (TSX:X) owns and operates Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV), a unique two-tiered marketplace that has a 165+ year history of supporting and incubating small public companies.

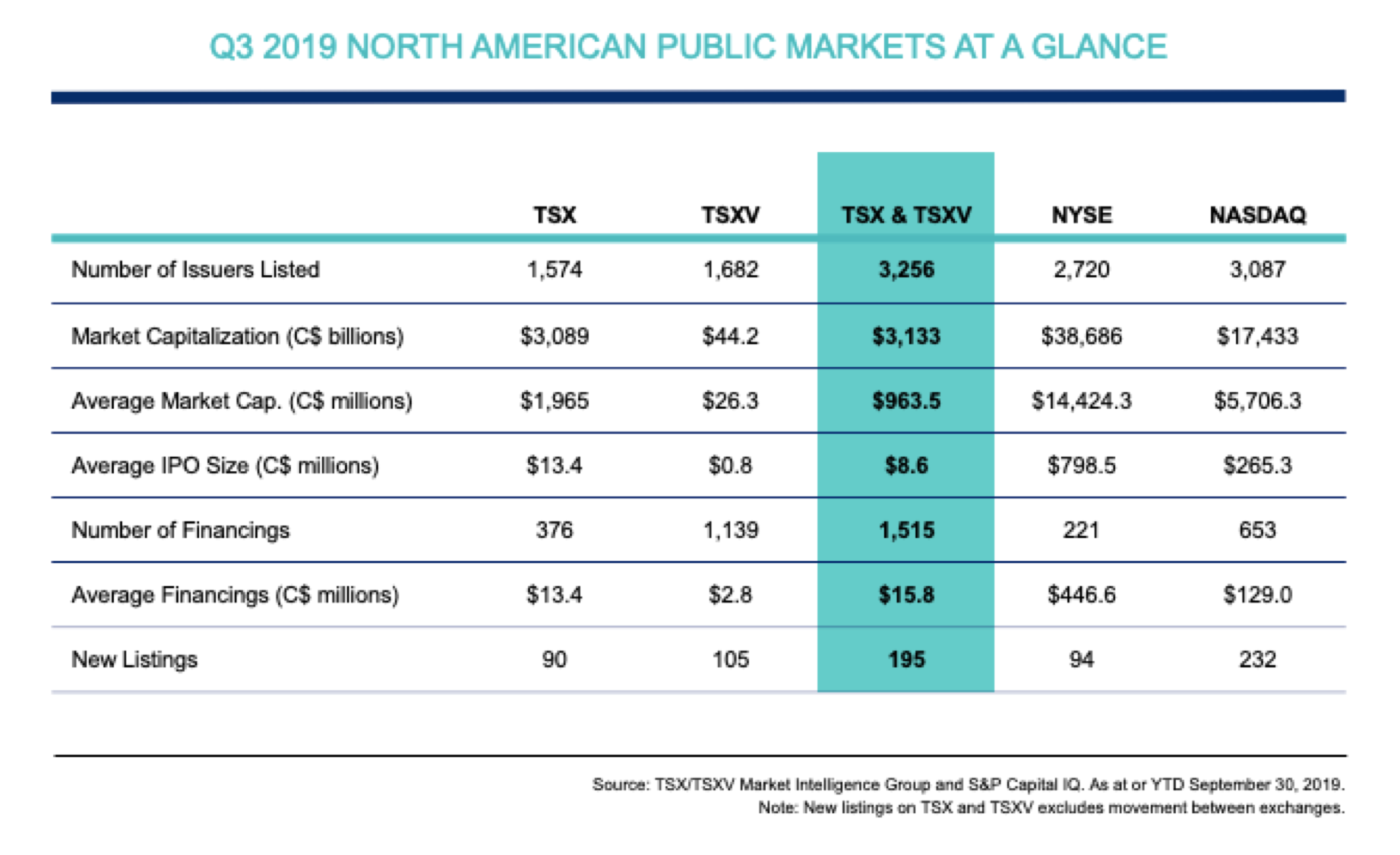

TSX is the senior market for larger, more stable companies with a track record. The average financings on TSX fall in the $25-$100M range and have an average market cap of $2.0B. These companies benefit from increased analyst coverage and being eligible for index products. For smaller, early stage growth companies, TSXV is a unique platform that is tailored to companies of this size. TSXV provides financings typically in the $5-$25M range and these issuers have an average market cap of just $26M.

Comparatively, Nasdaq and NYSE today service much larger companies with the average market cap of their listed issuers at $5.7B and $14.4B respectively. This table also shows the difference in the number and average financings, indicating TSX and TSXV’s platform for “public venture capital”.

So why does this matter to US companies? Because TSX and TSXV have listing requirements and corporate governance that are “right-sized” for growth companies. The opportunity to access public venture capital through the Canadian capital markets is an increasingly viable alternative.

Currently, over 100 US companies are listed on TSX or TSXV collectively raising $9B in the last five years. 35 new US listings came to market in this same time period. And six of the 2019 TSX Venture 50, which ranks the top performers on TSXV, are based in the US.

Los Angeles-based OjO Electric (TSXV:OJO) recently listed on TSXV, raising CDN$8M to fuel the growth of its electric scooter business. “At OjO, we’re proud to drive the micro-mobility revolution and are changing rideshare for good. We are thrilled to list on TSX Venture Exchange and now have a solid base from which to accelerate our product roadmap and market penetration,” said Max Smith, CEO.

For US companies seeking Series B+ growth capital, here are a few things to consider:

Know your funding options. There are many sources of growth capital available to US companies, including angel investors, venture capital, private equity, venture debt, equity crowdfunding, the over-the-counter (OTC) public market, and senior stock exchanges Nasdaq and NYSE. And there is “public venture capital” on TSX and TSXV. Be clear on what you are building and why, and evaluate the pros and cons of each option. Consider these factors: cost of capital (debt versus equity), maintaining control, alignment with the long term vision for the company, time and cost of reporting requirements, and value-add that comes with the capital (contacts, advice, industry expertise).

Understand public venture capital. Learn about the uniqueness and opportunity in public venture capital and the potential benefits of using the Canadian public markets to grow your company. Rather than taking on the potentially onerous terms of private equity or venture capital, consider that you can likely maintain greater ownership and operational control by going public on TSXV.

Have a reason to go public. Ensure your company would benefit from being public, including: access to capital; acquisition currency; incentive for attracting and retaining top talent through stock options; diversified shareholder base and flattened cap table; and the credibility and profile of being listed on an internationally recognized stock exchange.

Focus on long term growth. Once public, the most successful CEOs focus on executing the company’s business plan and less on watching the stock price. It is critical to manage investor expectations by communicating your companies long term strategy and by investing in quality investor relations.

TSX and TSXV are a unique funding and listing platform for high growth US companies looking to raise Series B+ capital. Companies with early revenue, a strong management team, and a growth strategy to eventually list on a US exchange should consider the Canadian capital markets as an alternative that may be the right fit.

For more information, contact Delilah Panio, VP of US Capital Formation, Toronto Stock Exchange, at delilah.panio@tmx.com.

Section 7702 of the IRS Code - A Little-Known Opportunity for Business Owners, Executives and Key People

Section 7702 of the Internal Revenue Code creates a way to accumulate earnings on a tax-deferred basis and distribute lump sums or structured incomes on a tax-free basis. This creates a highly similar result to a qualified plan, but is not subject to the same requirements, rules and restrictions.

Authors: Mark Rooney, CFP®, ChFC, CLU, Founder and Managing Partner and Jamie C. Smith, JD, Managing Partner, The Business Strategies Group of Southern California

· There are 5.8 million small businesses (less than 100 employees) in the United States alone.

· Small businesses represent 98% of the private (non-governmental/non-profit) entities in the country.

· Small businesses employ 42 million people, which is 47.5% of the private sector workforce.

· 63% of the new jobs in America over the past two decades were created by small businesses.

· 51% of business owners are over age 50 and only 16% are under age 35.[1]

Business owners, executives and key employees must juggle many balls and have knowledge in various and diverse areas that do not directly relate to the nature of their business. One common concern is accumulating funds for retirement, particularly in a tax-advantaged manner.

Company retirement plan such as 401(k), defined contribution, profit-sharing, simplified employee pension (SEP), and more are attractive approaches. A properly constructed and government approved plan can make retirement contributions tax-deductible and allow potential earnings to grow tax deferred. Taxes are levied only when money is distributed from the plan, either in a lump-sum or structured as income.

While these retirement plans can provide greater accumulation and distribution possibilities than purely “saving or investing“ on your own, the plans must “qualify” for the tax benefits by adhering to important regulations of the IRS, the Department of Labor (DOL) and the Employee Retirement Income Security Act (ERISA).

Some of the rules include, but are not limited to…

· Non-discrimination provisions

· Vesting (account ownership) requirements

· Required timing of distributions

· Access to funds without penalty

· Flexibility of contributions

· Administration, reporting and audit requirements

· Investment and savings options

· Employee education

· Expected benchmarking

…and many more.

When properly designed and administered, these “QUALIFIED” plans are considered a tremendous tool to develop retirement income and an important tax preference provided by the government to encourage retirement self-reliance.

The challenge to many owners, executives and highly compensated employees is that the allowable contributions vary by plan type and are limited by regulation.

This commonly creates a scenario where an employee compensated at $60,000 a year can retire on 100% of their pay, while the ownerreceiving $400,000 per year may retire on only 39% of their previous income.

Take the $60,000 earner who works at the company for 30 years and contributes 10% of their income to the company retirement plan. Combine those contributions with moderate earnings in the plan and their annual retirement income from the plan could approximate $2,800 per month. Add that to approximately $2,200 per month from Social Security, and you have $5,000 per month (or $60,000 per year). That is 100%!

The $400,000 per year owner/executive will get roughly $3,000 per month from Social Security and approximately $10,000 per month from their company plan, all variables being equal. Thus, the higher paid person has $156,000 per year in retirement income. That is only 39%!

This occurs because the amount of money the higher paid person can contribute to the plan is “CAPPED“ by regulation at an average of $20,000 per year. This involves both hard-dollar limitations and caps on the amount that is considered “eligible” income for contributions to the plan.

Table 1: Hypothetical Retirement Income Example (Employee vs. Owner/Executive)

IS THIS FAIR??? According to the regulations that apply to “Qualified Plans” it is!

ANOTHER (OR ADDITIONAL) APPROACH

Section 7702 of the Internal Revenue Code creates a way to accumulate earnings on a tax-deferred basis and distribute lump sums or structured incomes on a tax-free basis. This creates a highly similar result to a qualified plan, but is not subject to the same requirements, rules and restrictions.

The plan can be highly selective (versus non-discriminatory) and it is virtually uncapped. Many have likened it to an unlimited “Roth“ plan. Used properly, it can make up the difference between 39% (or whatever your number is) and 100%.

Section 7702 of the IRS code governs how much money can be accumulated inside a life insurance policy without being currently taxed (tax-deferred). It also indicates how, properly designed and administered, those accumulated funds can be distributed on a non-taxed, non-reportable basis. Thus, a 7702 plan can provide comparable benefits to a qualified plan in terms of accumulation, distribution and even investment flexibility, but on an entirely selective and uncapped basis. Indeed, virtually none of the “rules“ required in a qualified plan impact a 7702 (sometimes called non-qualified) plan.

Utilizing 7702 enables a company to provide parity for highly paid employees, executives and owners. Our $400,000 owner mentioned earlier could indeed fund a tax advantaged plan to provide a $400,000 post-retirement income.

BUT WAIT – THERE’S MORE

The asset being used to accumulate and distribute these funds is a permanent form of life insurance. Repurposing cash (the premium) into “cash value“ to create this unique tax status, creates other opportunities for the business and business owner because there is an inherent death benefit provided by the life insurance contract.

Some of these opportunities are…

· Contingency capital – the cash value[2] is always accessible and is not restricted by early or late distribution rules

· The Death Benefit can be used in multiple ways without disrupting the funding or distribution process, including but not limited to…

o Estate planning – in terms of liquidity and/or equalization

o Funding “buy/sell“ agreements

o Key person coverage

o Succession planning and other forms of exit strategies

o “Perks“ such as split-dollar protection for key people

o Family income and educational funding needs

…and more.

Most of this is accomplished through drafting of agreements by counsel that would codify desired uses for the death benefit, and all of this is controlled by the owner and could be modified as circumstances change.

INTERNATIONAL ISSUES

Because life insurance contracts are the financial instrument supporting the plans discussed, and the tax ramifications of the contracts are based on IRS code, it is important that the insurance policies be U.S.-based.

In one sense this is very good, as the U.S. policies are as cost-effective as any that exist in the world. But the underwriting requirements and country-by-country treaties to make them available to non-US citizens/residents vary widely. A handful of insurance companies do have “international underwriting“ programs that will issue U.S. dollar-denominated policies on foreign nationals with a nexus to the U.S. (financial, residential, employment, etc.). Issues also apply to U.S. citizens working or residing abroad.

The many variations by country (and even city), make details on this process too complex for this article. Fortunately, one of the easiest countries to work with is Canada. Thus, issues of…

· Canadians working and/or living in the United States

· Americans working or living in Canada

· Employees and principals with “other“ citizenship

…present a lesser challenge in obtaining U.S.-based insurance contracts to support the various concepts discussed in this article.

A thorough understanding of section 7702 and other sections of the IRS code relating to U.S. life insurance contracts can provide often-missed opportunities for business owners, executives and key people, both in the U.S. and, to a large extent, Canada as well.

Mark Rooney, as an agent, offers fixed insurance products through AXA Network Insurance Agency of California, LLC and through an International Underwriting Program. As a registered representative of AXA Advisors, LLC (NY, NY 212-214-4600), member FINRA, SIPC, he is not authorized to offer securities products and services outside of the United States. AXA Advisors, its affiliates, and financial professionals do not provide tax or legal advice.

For further information or clarity on the items discussed in this article, please contact Julie Drogrez Lopez, Financial Consultant, AXA Advisors LLC at (619) 557-8427 or at Julie.DrogrezLopez@Axa-Advisors.com.

[1] All of these statistics are derived from the 2018 Life Insurance Marketing Research Association (LIMRA) Small Business Research Series Project.

[2] Loans and withdrawals reduce the policy's cash value and death benefit, and withdrawals in excess of the policy's basis are taxable. Under current rules, loans are free of income tax as long as the policy remains in effect until the insured's death, at which time the loan(s) will be satisfied from income-tax-free death benefit proceeds, and, if the policy is surrendered, any loan balance will generally be viewed as distributed and taxable.

PPG-148770 (10/19) (Exp. 10/21)

How U.S. Companies Can Enter the Canadian Market

Canada is an attractive place for businesses interested in establishing a presence in another country. Canada presents a stable economy and a welcoming environment for international investors. In this article, we will discuss the ins and outs of public M&A transactions for any company interested in the Canadian market. From plans of arrangement and takeover bids, to acquiring a minority interest in a company and advising on the Investment Canada Act, find out how you can gain a foothold in Canada.

Author: Kent Kufeldt (Partner and National Practice Group Leader for BLG’s Securities and Capital Markets Group)

Canada is an attractive place for businesses interested in establishing a presence in another country. Canada presents a stable economy and a welcoming environment for international investors. In this article, we will discuss the ins and outs of public M&A transactions for any company interested in the Canadian market. From plans of arrangement and takeover bids, to acquiring a minority interest in a company and advising on the Investment Canada Act, find out how you can gain a foothold in Canada.

Canada’s Open Economy with Few Significant Regulatory Requirements

As an open economy, Canada has very few limitations on foreign investment. Throughout the years, Canada has seen investment from all over the world into many sectors of the Canadian economy. Not surprisingly, investment from the United States is considerable, but we have also seen many M&A transactions originating from Europe and more recently from Asia.

There are very few significant regulatory requirements which must be satisfied when conducting a public M&A transaction in Canada. Our principal foreign investment review legislation is known as the Investment Canada Actand it applies when a non-Canadian purchases a Canadian business. Over the last number of years, the review thresholds applicable to M&A transactions have been increased so that only high value transactions are subject to review. In particular, direct investments involving Canadian businesses by investors from WTO member nations are only reviewable where they have an enterprise value in excess of just over $1 billion. Similarly, where the investment originates from a country with whom Canada has in place a multilateral or bilateral trade agreement, transactions only become reviewable when they involve an enterprise value of slightly over $1.5 billion.

There are, however, a few exceptions to these review thresholds. Lower thresholds apply to acquisitions of cultural businesses such as publishing, film, music and broadcasting. In addition to the Investment Canada Act, certain industries, such as banking and airlines, have specific foreign ownership restrictions.

Should a transaction be reviewable, that review typically takes between 45 and 75 days following the announcement of the transaction. As is the case in the United States, there is also a national security test similar to the US CFIUS process, which can potentially prohibit a transaction that raises national security issues. The national security test is very broad and should always be considered in transactions which have a connection to Canada’s defence industry, sensitive technologies or which involve companies critical to the provision of goods and services to Canadians.

Typical Types of Public M&A in Canada

In Canada the principal form for a public M&A transaction is what is known as a plan of arrangement transaction. A plan of arrangement is completed under Canadian corporate law statutes and usually involves a negotiated transaction between the purchasing company and the target. A plan of arrangement requires the approval of the target company’s shareholders on a special majority basis (typically two-thirds approval). In addition, a plan of arrangement must be approved by a Canadian court, which assesses the fairness and reasonableness of the transaction. A plan of arrangement is the acquisition structure of choice for almost all negotiated transactions because by its nature, it is a flexible form of transaction which can address securities law, tax law and corporate commercial considerations all in the same transaction. It also has the advantage of resulting in the acquisition of 100% of the target company in a single step as long as the transaction receives the approval of two-thirds of those shares voted at a meeting held to consider the transaction.

Another typical form of public M&A transaction is a takeover bid. Takeover bids are subject to the rules of the Canadian securities regulators and involve an offer made by the purchasing company directly to a target company’s shareholders. Often takeover transactions are negotiated, however takeover bids can also be conducted on a hostile basis with an offer made directly to a target company’s shareholders without the support of the target company or its board of directors.

Unlike a plan of arrangement, there is a possibility that a takeover will require a two-step process to arrive at 100% ownership, adding time and cost to a transaction. This is because where less than 90% of a target company’s shareholders accept the offer, a second stage plan of arrangement or amalgamation transaction would be required to purchase the remaining shares. The possibility of requiring a two-step transaction process to complete an acquisition has resulted in the plan of arrangement structure becoming the dominant form of M&A transaction in Canada.

Use of Hostile or Unsolicited Acquisitions in Canada

Hostile transactions are permissible in Canada and are generally conducted by way of a takeover bid. Recent changes in our Canadian securities laws have required that an unsolicited takeover bid remain open for acceptance for at least 105 days and that before an acquiring company can take up shares tendered to the takeover bid, at least 50% of the target company’s shares must be tendered in acceptance of the offer. While the 105 days represents a long time to have an offer remain open for acceptance, our Canadian securities regulators have balanced this by severely restricting and monitoring the ability of a target company to conduct defensive tactics which could stop a bid from being considered by its shareholders. In the event that the transaction turns friendly, the target company has the ability to shorten the deposit period.

Considerations for Acquiring a Minority Interest in a Canadian Target

It is common to see investors from outside of Canada undertake minority investments in Canadian businesses prior to undertaking a merger transaction. Like other jurisdictions, acquisitions of minority interests in public Canadian companies can trigger reporting requirements. Any acquisition of greater than 10% of a public company requires the preparation and filing of an early warning report and insider reports similar to the filings required under US securities laws. In Canada, an acquisition through public market purchases of greater than 20% of a company’s issued and outstanding shares will generally trigger the application of our takeover bids rules and the necessity to make an offer to all shareholders. Therefore, it is very common for parties seeking to obtain a minority interest to limit their purchases to no more than 19.9% of a target company’s shares.

Once a decision is made to acquire additional shares, a takeover bid or plan of arrangement transaction can be undertaken by the investor. Depending on the circumstances, special rules may apply to a merger and acquisition transaction conducted by an insider of the Company. These rules can trigger enhanced governance requirements and independent valuation requirements of the shares of the target company.

As the rules regarding minority investments and a subsequent go private transaction can be somewhat complex, it is always recommended that purchasers looking to undertake a minority investment do so in consultation with Canadian legal advice to ensure compliance with the rules during the acquisition and any follow-on M&A transactions.

Borden Ladner Gervais LLP

As Canada’s largest law firm, BLG is well-organized to assist clients from all over the world who are looking to undertake a public M&A transaction in Canada.

For more information on how U.S. companies can excel within the Canadian market, refer to Borden Ladner Gervais’ Legally Educated – BLG Video Series for valuable insights on today's major news-making industries.

New RSM Research Explores Cybersecurity Concerns and Vulnerabilities for Middle Market Businesses

Middle market leaders increasingly recognize the heightened risk of cyber threats and data breaches that are continuing to capture headlines, but fail to realize they are prime targets for cyber attacks. That’s according to results from the RSM US Middle Market Business Index (MMBI) Cybersecurity Special Reportreleased from RSM US LLP (“RSM”), in partnership with the U.S. Chamber of Commerce.

The survey revealed that the middle market is confident in cybersecurity protections yet remains among the most vulnerable to attacks.

Middle market leaders increasingly recognize the heightened risk of cyber threats and data breaches that are continuing to capture headlines, but fail to realize they are prime targets for cyber attacks. That’s according to results from the RSM US Middle Market Business Index (MMBI) Cybersecurity Special Reportreleased from RSM US LLP (“RSM”), in partnership with the U.S. Chamber of Commerce.

The report found that 15 percent of middle market executives indicated that their companies experienced a data breach in the last year, up from 13 percent in 2018 and a significant jump from 5 percent just four years ago. Additionally, more than half (55 percent) of respondents believe that an attempt to illegally access their company’s data or systems is likely in 2019, an increase from 47 percent in 2018. Larger middle market organizations continue to be most at risk for cybercrime, as many have high volumes of valuable data but don’t have the robust security resources of their large-cap peers, making them exceedingly attractive to cybercriminals.

In terms of the types of attacks, ransomware has become the most popular breach method for cyber criminals – evolving from a nuisance to a major threat because of its highly targeted nature. RSM found that over one-third of middle market executives (35 percent) know someone that has suffered a ransomware attack, compared to 31 percent in 2018, while 20 percent have suffered an attack themselves, a two percentage point increase from last year. Social engineering has also become prevalent, with 42 percent of executives reporting social engineering attempts on their organizations from outside parties.

However, while executives are taking notice of looming cyberthreats, and the number of reported breaches has tripled over the last five years, the majority (93 percent) are confident in their organization’s security measures, which is likely due to increased investments in cybersecurity tools and initiatives. This growing confidence of middle market leaders conflicts with rising concerns, and research shows that companies need to remain diligent.

“One of the most apparent trends from the report is the confidence middle market leaders have in the effectiveness of their security controls,” said Daimon Geopfert, principal and national leader of security & privacy services with RSM US LLP. “While the headlines may focus on the breaches experienced by large corporations, the glaring reality is that the often-overlooked middle market is a prime target. The jeopardy to this sector is growing, and firms must ensure that security investments, controls and communication align with rising threats.”

Responding to a Rapidly Evolving Regulatory Environment

A growing number of countries and states are beginning to enact cybersecurity legislation to mitigate risk and strengthen data protection. Many middle market companies are required to comply with the European Union’s General Data Protection Regulation (GDPR), and legislation is already emerging in the U.S., led by the California Consumer Protection Act, which is scheduled to take effect in 2020.

These regulations are expected to impact the middle market, yet companies have been slow to develop GDPR-compliant privacy processes. In fact, only 40 percent of respondents are familiar with the requirements of the GDPR law or other privacy regulations.

It is imperative for middle market companies to start building familiarity with existing regulations now, so these policies can serve as a helpful foundation to prepare for what is certain to be an active future for data privacy.

Cyber Insurance: Future-Proofing Security

To combat the repercussions that cybercrime threats like ransomware can have on organizations’ financials and operations, cyber insurance has become an effective and critical solution.

More than half (57 percent) of middle market executives surveyed carry cyber insurance to mitigate risk, a five percentage point increase from 2018. While the usage of cyber insurance is gaining momentum and popularity, many executives do not have a full understanding of their policies and coverage. In fact, the survey reveals that 41 percent of the companies that carry policies are somewhat familiar or not at all familiar with their coverage levels.

“Executing a cyber insurance policy is important to limit exposure, and it’s encouraging that there has been an uptick in implementation among middle market firms,” said Ken Stasiak, consulting principal with RSM US LLP. “But companies must also remember to periodically evaluate any existing insurance policies to account for evolving and emerging risks.”

As cyber attacks continue to grow in severity, scope and scale, executives must stay aware of potential vulnerabilities and understand the most effective methods to alleviate the risk. The most effective cybersecurity strategies will protect data, identify and address threats, and scale to encompass emerging technology, business expansion and other challenges.

The survey data that informs the index reading was gathered between January 14 and February 1, 2019. To learn more about the middle market and the MMBI, visit the RSM website.

About the RSM US Middle Market Business Index

RSM US LLP and the U.S. Chamber of Commerce have partnered to present the RSM US Middle Market Business Index (MMBI). It is based on research of middle market firms conducted by Harris Poll, which began in the first quarter of 2015. The survey is conducted four times a year, in the first month of each quarter: January, April, July and October. The survey panel consists of 700 middle market executives and is designed to accurately reflect conditions in the middle market.

Built in collaboration with Moody’s Analytics, the MMBI is borne out of the subset of questions in the survey that ask respondents to report the change in a variety of indicators. Respondents are asked a total of 20 questions patterned after those in other qualitative business surveys, such as those from the Institute of Supply Management and National Federation of Independent Businesses.

The 20 questions relate to changes in various measures of their business, such as revenues, profits, capital expenditures, hiring, employee compensation, prices paid, prices received and inventories. There are also questions that pertain to the economy and outlook, as well as to credit availability and borrowing. For 10 of the questions, respondents are asked to report the change from the previous quarter; for the other 10 they are asked to state the likely direction of these same indicators six months ahead.

The responses to each question are reported as diffusion indexes. The MMBI is a composite index computed as an equal weighted sum of the diffusion indexes for 10 survey questions plus 100 to keep the MMBI from becoming negative. A reading above 100 for the MMBI indicates that the middle market is generally expanding; below 100 indicates that it is generally contracting. The distance from 100 is indicative of the strength of the expansion or contraction. The MMBI Cybersecurity Special Report also includes data from the NetDiligence® 2018 Cyber Claims Study.

About RSM US LLP

RSM’s purpose is to deliver the power of being understood to our clients, colleagues and communities through world-class audit, tax and consulting services focused on middle market businesses. The clients we serve are the engine of global commerce and economic growth, and we are focused on developing leading professionals and services to meet their evolving needs in today’s ever-changing business environment.

RSM US LLP is the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 41,000 people in 116 countries. For more information, visit rsmus.com, like us on Facebook, follow us on Twitterand/or connect with us on LinkedIn.

Canada’s Growing E-Commerce Market Offers Opportunities – and Challenges -- for California Businesses

Clearly, there has never been a better time for California businesses to expand e-commerce operations to the Canadian market. But before a business decides to take that potentially lucrative step, it’s vital to recognize that selling to Canada is different from selling within the U.S., and requires careful planning, especially with regard to logistics and delivery.

Paul Tessy, Senior Vice President, Purolator International

A July 2019 webinar sponsored by Canada Postrevealed a few interesting statistics about the Canadian e-commerce market: First, that 80 percent of Canadians are online shoppers, and almost 70 percent of those shoppers have made purchases from U.S. retailers. This represents a market of roughly 30 million consumers. And second, Canada’s e-commerce market is growing. A lot. By 2022, online sales are projected to increase by a whopping 87 percent over 2016 levels.

As the webinar leader summarized: “Canadians have money. They like to shop. And they plan to shop more.”

Clearly, there has never been a better time for California businesses to expand e-commerce operations to the Canadian market. But before a business decides to take that potentially lucrative step, it’s vital to recognize that selling to Canada is different from selling within the U.S., and requires careful planning, especially with regard to logistics and delivery.

For one thing, a California business will quickly learn that Canadian consumers have expectations for fast, on-time deliveries that are similar to U.S. shoppers. And that last mile flexibility and efficiency matter as much in Canada as in the United States.

But meeting those expectations can be tricky. Shipments from the U.S. must cross an international border, and are subject to customs fees and tariffs that can drive up the cost of a product. Another unwelcome surprise is that most U.S. transportation providers do not have distribution networks in Canada. Many U.S. retailers have mistakenly assumed their highly-efficient U.S. logistics strategies could simply be replicated in Canada, only to have their time-sensitive e-commerce shipments arrive days later than expected.

A U.S. retailer can meet Canadian consumers’ e-commerce expectations. The key is to partner with a logistics company that not only has the requisite experience and capabilities in Canada, but is a proven innovator in building solutions that address the realities of e-commerce shipping.

Purolator International specializes in providing logistics services for shipments moving between the United States and Canada. This experience affords us unique insight to the needs of U.S. retailers trying to ship e-commerce packages into Canada, the expectations of Canadian consumers, and an understanding of what is possible. The good news, is that the “what is possible” has kept pace with – and even outpaced -- the “what is expected.”

The First Mile

For starters, let’s discuss what we refer to as “the first mile.” This involves the process involved in picking up a shipment and bringing it to the Canadian border. We regularly hear from California businesses, especially those located in southern California, that have been disappointed to learn their shipments would take 4-5 days just to reach the border. Not to clear the border mind you, just to arrive.

This generally occurs because many transportation companies that own their own fleets are locked in to following rigid schedules. Shipments are often picked up and brought to a hub where they are sorted and reloaded onto another truck. Once enroute, the truck will make multiple stops along the way.

A better solution is to enlist a company that does not own its own trucks and instead can pick-and-choose from an array of options. A San Diego retailer, for example, would benefit from having its shipments picked up by a truck moving directly north, rather than a truck that must make stops in Arizona or Nevada.

Inventory management is another consideration in which a non-asset-based provider can be helpful. A retailer must determine its best course for ensuring proper amounts of inventory are readily available to fulfill Canadian orders. With an efficient transit plan in place, this may be accomplished from a U.S-based warehouse. Or, a retailer may wish to store inventory in a Canadian facility, available through its logistics provider.

Shipment consolidation has become an essential component to an e-commerce logistics solution. Through consolidation, several benefits are possible:

· Freight and small package shipments can be picked up at the same time, and travel on the same truck to the border. This important capability saves both time and money.

· Smaller shipments are combined, which often means the larger shipment qualifies for a reduced freight rate.

· Consolidated shipments will clear customs as a single entry. This avoids having to submit separate Canada Border Services Agency (CBSA) paperwork and documentation for each individual unit.

A logistics provider that is able to offer a “best possible” solution, that includes consolidation efficiencies, can usually ensure a shipment’s arrival at the border days faster than a more rigid “best we can do” solution.

Customs Efficiency

Consolidation is one example of how an experienced logistics provider can help facilitate the border clearance process. There are other ways as well. For starters, a logistics provider should have a good understanding of CBSA requirements, and be able to ensure that all required documentation is accurate and thorough. This may sound obvious, but incomplete/missing paperwork is a top reason for shipment delays.

Duty and tax payment is another important consideration. All shipments entering Canada are subject to sales taxes and customs fees, and may be liable for permit licenses and other fees. A California business selling to a Canadian customer will need to determine its best course for collecting those taxes and fees. While most e-commerce customers expect to be charged a landed, all-in cost at time of purchase, the Canadian government places restrictions on parties authorized to collect taxes and serve as “importer of record.”

An experienced provider will offer guidance to ensure full compliance, and will also participate in CBSA’s Courier Low-Value Shipment program. This offers expedited clearance for shipments valued at less than CAN$2,500 entering Canada via an approved courier.

The Last – and most important -- Mile

Once a shipment arrives in Canada, what happens next will make or break the delivery experience. Last mile efficiency is a non-negotiable must-have, even for shipments arriving from the United States. This begins of course, with a seamless distribution plan that ensures fast, on-time delivery.

The problem though, is most carriers simply do not have this capability. Instead, a U.S. carrier will generally transfer shipments to a Canadian carrier. But, since most Canadian carriers offer only regional service, a network of carriers will have to be assembled to ensure coverage throughout the entire country.

Purolator International is able to offer seamless service throughout Canada. This is because Purolator International is the U.S. subsidiary of Purolator Inc., a leading Canadian integrated freight and parcel delivery company. Through this relationship, we have access to a distribution network that reaches every province and territory. And with regard to e-commerce deliveries to residences and businesses, we benefit from Purolator Inc.’s affiliation with Canada Post, that country’s national post office. Afterall, what better entity to ensure access to 100 percent of local addresses than the post office?

With an experienced, innovative logistics provider on its team, a California business can fully meet the expectations of Canadian online customers. For those of us in the business of building logistics solutions, it’s never been a more exciting time. Today it is possible to have shipments arrive in Canada faster, and more efficiently than was previously thought possible. The key though, is having a solid logistics plan in place, and the right partner on your team.

Seeking Competitive Advantage in Divergent Immigration Systems: An Overview of Canada and U.S. Immigration

Canada and the United States have separate and increasingly divergent immigration systems. Each country’s immigration policies and platforms have strengths and weaknesses. I will compare and contrast their immigration systems for two distinct purposes: (1) to highlight how a North American business integrated immigration approach can provide a competitive advantage; and (2) to provide a context and useful insight into potential comprehensive U.S. immigration reform. I will first review the U.S. immigration system and then contrast Canada’s immigration system.

Andrew Cumming, Founder and Managing Partner of Toronto-based Cumming & Partners.

In today’s competitive global economy, access to highly skilled employees is critical to business success. For many businesses in North America, attracting and keeping top talent (including foreign workers) is a key component of their business model.

Canada and the United States have separate and increasingly divergent immigration systems. Each country’s immigration policies and platforms have strengths and weaknesses. I will compare and contrast their immigration systems for two distinct purposes: (1) to highlight how a North American business integrated immigration approach can provide a competitive advantage; and (2) to provide a context and useful insight into potential comprehensive U.S. immigration reform. I will first review the U.S. immigration system and then contrast Canada’s immigration system.

U.S. Immigration

There have not been comprehensive changes to the U.S. immigration system for several decades. Although there is a consensus that significant changes are required, the political complexity of addressing legal immigration reform (work visas, green cards) in conjunction with resolving the status of more than 10 million illegal immigrants has proven insurmountable.

U.S. Work Visas

H-1B Work Visas

The H-1B work visa is the cornerstone of the U.S. work visa system. This work visa allows a U.S. business to hire a foreign (professional) worker who has a specialized university degree for a position that requires such a credential. The foreign worker must be paid the prevailing wage, but there is no labor market test required. U.S. Immigration restricts the ability of U.S. companies to hire foreign workers on H-1B visas by placing an annual numerical cap (85,000) on the number of such work visas available each year. Each April 1st, applications are accepted (in 2019 approximately 190,000 applications were filed) and a lottery occurs to determine which foreign workers are chosen.

L-1 (Intra-Company Transfers) Work Visas

Foreign workers who have worked abroad for one year or longer for a company affiliated to a U.S. business can transfer to the United States on an L-1 work visa if they work in an executive, managerial, or specialized knowledge capacity.

TN (NAFTA) Work Visas

Professionals who are Canadian (or Mexican) citizens working in one of the approximately sixty listed professional occupations have access to TN work visas under NAFTA. These TN visas facilitate fast and easy access to the United States (immediate in-person processing upon entry) provided the applicant has the required education and the U.S. position fits into one of the listed occupations. NAFTA work visas are the key for professional worker mobility between Canada and the United States.

O-1 (Outstanding Ability) Work Visas

The O-1 work visa is for any foreign worker who can document outstanding ability in their field within the arts, sports, science or business.

E-1/E-2 Treaty Traders/Treaty Investors

The United States has commerce treaties with more than fifty countries that allow citizens of those countries U.S. work visas if their foreign business is undertaking substantial trade with the United States (E-1 Treaty Trader visas) or substantial investment in the United States (E-2 Treaty Investor visas).

U.S. Permanent Residence (Green Cards)

PERM (Labor Certification)

Employees in the United States who want to sponsor a foreign worker for a Green Card can undertake the Labor Certification process of advertising the position to prove that no U.S. worker (with the requisite credentials) is available. This Labor Certification process, if successful, allows the foreign worker to apply for a Green Card.

Green Card availability is restricted by an annual quota system that applies to both eligibility categories and also nationality. This has resulted, in many circumstances, in significant delays in obtaining Green Cards particularly for citizens of India, and China.

Multinational Executives/Extraordinary Ability

Exempt from the Labor Certification process are executives and managers of multinational companies and individuals who can document their extraordinary ability in the arts, sports, sciences or business.

Contrasting Canadian Work Permit Options

LMIA Work Permits

The Labour Market Impact Assessment (“LMIA”) work permit is Canada’s standard work permit for a foreign worker. In contrast to the H-1B visa, there is no annual numerical cap. However, and also in contrast to the H-1B visa, the LMIA work permit is restricted by a labour market test whereby a Canadian employer must advertise the position and prove there is no Canadian worker (with the appropriate credentials) available.

Intra-Company Transferee/NAFTA Work Permits

The Canadian rules for intra-company transferee work permits closely parallel those of the U.S. L-1 visas. That is also the case for Canadian NAFTA work permits vis-à-vis U.S. TN visas. Unlike the United States, in addition to NAFTA Canada has significant labour mobility provisions in its CETA (Comprehensive Economic and Trade Agreement with Europe) and CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership with 10 Asia-Pacific countries) trade agreements.

Significant Benefit

Canada issues work permits for individuals of outstanding ability (in parallel to the U.S. O-1 visa) under the Significant Benefit category. Significant Benefit work permits are, however, significantly more flexible than O-1 visas as they can be issues not only where the applicant has outstanding ability (like the O-1) but also where the applicant lacks outstanding ability but is still contributing significantly to Canada’s economy or culture. This gives Canadian Immigration significant latitude to broadly issue Significant Benefit Work Permits.

Contrasting Canadian Permanent Residence Options

Canada continues to aggressively focus on economic growth through immigration. Last year, Canada welcomed approximately 300,000 permanent residents and the federal government has stated the goal of admitting 1.1 million new permanent residents between 2019 and 2021.

Express Entry System

This online immigration program facilitates the selection of immigration based on an applicant’s ranking score. Points are given for education, language skills, work experience, and age (youth). Unlike the U.S. Labour Certification process, sponsorship by an employer is not required. The system enables the best and brightest foreign workers to obtain permanent residence in Canada in 6 to 9 months and is focused on attracting young, well-educated professionals. In contrast to the United States, Canada does not restrict permanent residency on a country-specific quota system, so all foreign applicants are on a level playing field regardless of nationality.

Provincial Nominee Programs

Provincial governments in Canada have considerable flexibility to shape their provincial nominee (immigration) programs to respond to specific economic and labour needs. The Canadian federal government has permitted provincial nominee programs to grow to the point where they admit about one-quarter of Canada’s economic immigrants every year. This shift to provincial (regional) input into federal immigration policy has not occurred in the United States.

Utilizing an Integrated North American Platform to Create a Competitive Advantage

The immigration policies and programs of both countries both have strengths and weaknesses. Understanding each country’s immigration policies allows you to recruit talent to North America through either country to maximize access to highly skilled foreign workers and produce a competitive advantage. This can be illustrated through two practical examples.

Example 1: Indian Software Engineer (Recent Stanford Graduate)

Ms. Graduate is an Indian citizen who is graduating at the top of her class in engineering at Stanford. She is being recruited by several top California-based technology companies.

Company A offers her a position on her Optional Practical Training (OPT) work authorization with the assurance they will enter Ms. Graduate in the H-1B visa lottery next April, and if they can obtain an H-1B visa for her (40% chance), then they will undertake a Green Card through Labor Certification (2 to 3 years) and then eventually (in approximately 10 years because of the back-log in Green Cards for Indian nationals) a Green Card will be obtained.

Company B makes a similar offer of support for U.S. immigration assistance but also explains that it has operations in Vancouver, Canada. And if Ms. Graduate is not chosen for an H-1B work visa, it is happy to move Ms. Graduate to Canada on a Canadian work permit and facilitate her Canadian Permanent Residence (1 year), or put her in a temporary position in Vancouver that would facilitate an L-1 (Intra-Company Transfer) work visa back to the United States after one year of work. Ms. Graduate chooses employment with Company B.

Example 2: Renowned Romanian Scientist

Company A is a top Canadian pharmaceutical company based in Toronto with additional offices in Boston. It has identified Mr. Research, a world-class Romanian scientist, as the ideal candidate to head up a new research project. Mr. Research is married, 55 years old, with two children preparing for university. He is brilliant but his English language skills are poor. He will not move to North America without the assurance the move can be permanent for both himself and his family.

Company A is concerned that although they can get Mr. Research a Canadian work permit, he may not qualify for permanent residency through the Express Entry program (poor English) and that other options will take time (and the two children will “age out” at 21 and not get permanent residency with their parents).

So alternatively, Company A recruits Mr. Research to its Boston office on an O-1 (Outstanding Ability) work visa with an undertaking to obtain Green Cards for Mr. Research and his family forthwith (through Extraordinary Ability which is not English language skill dependent). Mr. Research gladly accepts the offer for the Boston office.

Canadian Immigration Policies: Insight to Possible U.S. Immigration Reform?

Canada, not burdened by the illegal immigration issues that confront the United States, has in the past ten years taken significant steps (LMIA work permits, Express Entry Permanent Residency, Provincial Nominee Programs) to modernize its immigration system. These steps provide insight to possible U.S. immigration reform options.

Labor Market Test for Work Visa

The United States currently restricts the number of H-1B visas issued through an annual numerical quota system. That could change to restrictions based on proving labor market needs to hire foreign workers.

Emphasis on Highly Educated, Young Professional Workers

Canada developed its Express Entry program for permanent residency to compete with Australia and other countries who have modernized their immigration systems to attract the best and brightest young professional workers. Applicants do not require an offer from a Canadian employer (or a Labor Certification type process). The United States may follow with a points-based system for Green Cards to compete for this global talent.

Reduced Family-Based Immigration

Canada (and other countries) have reduced family-based immigration to emphasize points (merit)-based and economic- based immigration. This decision is based on the greater economic benefit of emphasizing professional workers over family-based immigration, and that may be a significant driver for comprehensive U.S. immigration reform.

Conclusion

Sophisticated immigration planning and the use of an integrated U.S./Canada approach for North American companies can provide a competitive advantage for sourcing and retaining highly-skilled foreign workers. Further, the immigration reforms that have occurred in Canada offer valuable insight into comprehensive immigration reform options for the U.S.

To learn more, please visit Cumming & Partners online at canada-usa.com or contact their Toronto office at (800) 523-2581.

Andrew Cumming, Founder and Managing Partner, acumming@canada-usa.com

Magda Kapitany, Director Business Development, mkapitany@canada-usa.com

A Tale of Two Currencies: The Greenback and the Loonie - Hedging currency risk in volatile markets